CRYPTO

Unveiling the Potential: Diving Deep into the dự án SCRT Token

New, exciting initiatives are constantly appearing in the dynamic world of Bitcoin, competing for investors’ dollars and boasting revolutionary improvements. The SCRT Token is one effort that has piqued the curiosity of cryptocurrency investors. This in-depth tutorial will examine the dự án SCRT token from every angle, covering its history, goals, technology, and possible influence on the decentralized ecosystem.

Understanding dự án SCRT token

Origins and Background

Secret Token, or SCRT for short, has its origins in the Secret Network. The Secret Network is a decentralized platform that allows safe and secret processing of smart contracts. It was launched to improve blockchain privacy and security. As the network’s original utility token, the SCRT Token is essential to the smooth running of the ecosystem as a whole.

Key Features and Technology

The SCRT Token stands out because of its emphasis on privacy. Even as smart contracts are being executed, Secret Network uses powerful encryption mechanisms to prevent sensitive data from being revealed, unlike many other blockchain networks. Industries that place a premium on data privacy can benefit greatly from this fresh perspective.

The SCRT Token is scalable and uses less energy since it uses a proof-of-stake consensus process. Because of this, Secret Network is now in a better position to handle applications with a large number of transactions, and it also has less of an effect on the environment.

Use Cases and Applications

Privacy-Preserving Smart Contracts

Safeguarding user privacy in electronic agreements is the main application for the SCRT Token. A Secret Network guarantees the privacy of intelligent contract inputs, outputs, and state changes by using secure multi-party computing (SMPC). This is unprecedented in sectors where safeguarding sensitive information is most important, including healthcare, supply chain, and finance.

Decentralized Finance (DeFi)

The decentralized financial industry is booming, and the SCRT Token is only one part. Financial transactions may be conducted securely with Secret Network-based DeFi applications that prioritize user privacy. This increases safety and makes DeFi more accessible to more people.

Tokenomics and Governance

SCRT Tokens are utilized for staking and governance purposes to encourage participation in the network. To keep the network safe and ensure that transactions are legitimate, stalkers are needed. In the meantime, token holders may participate in decentralized decision-making by voting on platform governance.

Future Outlook and Potential Impact

The SCRT Token initiative stands out in the rapidly developing blockchain sector due to its dedication to user privacy and security. Secret Network and its native cryptocurrency have a bright future ahead of them because of continual innovations, collaborations, and an expanding community. With its strong technical base and ability to affect many different industries, SCRT Token is sure to make a splash in the decentralized ecosystem.

Conclusion

Finally, when it comes to a decentralized future that is both secure and private, the dự án SCRT token is a giant leap forward. With its revolutionary technology, broad uses, and strong community backing, SCRT Token is positioned to make a lasting mark on the blockchain environment. Speculators and fans alike will do well to maintain tabs on Secret Network as events unfold and its native coin.

FAQs

What is the Secret Network?

Regarding decentralized blockchain platforms, privacy and security are top priorities on The Secret Network. It allows for the development and execution of smart contracts that employ sophisticated cryptography methods to safeguard private information.

How does the SCRT Token enhance privacy in smart contracts?

With secure multi-party computation (SMPC), SCRT Tokens are an integral aspect of privacy-preserving smart contracts. This makes smart contracts perfect for sectors that require extra precautions to protect customer information since it guarantees that any data entered into them, as well as any modifications made to their state, will stay private.

What are the key applications of the SCRT Token?

Decentralized finance (DeFi) and privacy-focused apps are among the many areas that find usage for the SCRT Token. Staking, governance, and rewarding network nodes for transaction validation and security are among its uses.

How does the proof-of-stake consensus mechanism benefit SCRT Token?

The SCRT Token is more efficient and scalable because of its proof-of-stake consensus method. Because of this approach, Secret Network is an excellent choice for applications that handle a large number of transactions while simultaneously reducing their environmental effect.

Can SCRT Tokens be used for decentralized finance (DeFi) activities?

The decentralized finance industry does make active use of SCRT Tokens. Financial transactions may be conducted securely with Secret Network-based DeFi applications that prioritize user privacy.

CRYPTO

The Ultimate Guide to Buy XEM P2B Exchanges

Are you ready to dive into the exciting world of buy XEM P2B exchanges? If you want to expand your cryptocurrency portfolio or explore new investment opportunities, you’ve come to the right place. In this ultimate guide, we’ll walk you through everything you need to know about purchasing XEM on P2B exchanges. From understanding what XEM P2B is all about to uncover the top exchanges in the market, get ready for a deep dive into the realm of digital asset trading! Let’s get started!

What is XEM P2B?

XEM, or NEM (New Economy Movement), is a popular cryptocurrency known for its unique features and versatility in the blockchain space. XEM operates on the NEM platform, offering users a secure and efficient way to transact digital assets.

P2B, short for Peer-to-Business, refers to the exchange model where individuals can directly interact with businesses within the crypto ecosystem. This type of exchange enables seamless transactions between retail investors and businesses looking to leverage digital currencies like XEM.

By utilizing P2B exchanges, traders can benefit from increased liquidity, lower fees compared to traditional platforms, and direct access to business opportunities that accept XEM as payment. This innovative approach fosters collaboration between individual investors and enterprises seeking to integrate cryptocurrencies into their operations.

In essence, XEM P2B represents a bridge connecting individual traders with business entities in the dynamic world of cryptocurrency trading.

The Benefits of Using XEM P2B Exchanges

When it comes to using XEM P2B exchanges, there are several benefits that users can enjoy. One of the main advantages is the speed of transactions on these platforms. With XEM P2B exchanges, you can buy and sell NEM quickly without having to wait for extended processing times.

Additionally, these exchanges offer a high level of liquidity, making it easier for traders to find buyers or sellers for their XEM tokens. This liquidity ensures that transactions can be completed promptly without any significant delays or complications.

Moreover, security is a top priority on XEM P2B exchanges, providing users with peace of mind knowing that their funds and personal information are protected from potential threats. By adhering to strict security protocols and encryption measures, these platforms offer a safe environment for trading activities.

Furthermore, many XEM P2B exchanges provide competitive fees and rates compared to traditional financial institutions or other exchange platforms. This cost-effectiveness allows users to maximize their investments and profits when trading NEM tokens seamlessly.

Factors to Consider When Choosing an Exchange

When choosing a P2B exchange to buy XEM, there are several key factors to consider. One of the most critical aspects is the exchange’s reputation and track record in the industry. Look for platforms with a history of security and reliability to ensure your funds are safe.

Another factor to keep in mind is the trading volume on the exchange. Higher trading volumes typically mean better liquidity and tighter spreads, making it easier to buy and sell XEM at competitive prices.

Consider also the fees charged by the exchange for trading XEM. Compare fee structures across different platforms to find one that offers transparent pricing and competitive rates.

Additionally, look into the user interface and features offered by each exchange. A user-friendly platform with advanced trading tools can enhance your overall experience when buying XEM.

Don’t forget to research customer support options. Choose an exchange that provides responsive customer service in case you encounter any issues during your trades.

Top XEM P2B Exchanges in the Market

Are you looking for the top XEM P2B exchanges to trade with? Well, look no further! In the vast market of cryptocurrency exchanges, there are a few standout platforms that cater specifically to XEM traders. These exchanges offer a user-friendly interface, high liquidity, and competitive fees.

One of the leading XEM P2B exchanges is Binance. Known for its extensive range of cryptocurrencies and advanced trading features, Binance provides a secure platform for buying and selling XEM tokens. Another popular choice among traders is Huobi Global. With its robust security measures and responsive customer support, Huobi Global has gained a strong reputation in the crypto community.

For those seeking a more beginner-friendly option, Bitfinex could be an excellent choice. This exchange offers various trading pairs for XEM and provides educational resources to help new users navigate the world of cryptocurrency trading. Consider these top XEM P2B exchanges when making your next trade!

Tips for Buying XEM on P2B Exchanges

When buying XEM on P2B exchanges, it’s essential to do your research and choose a reputable platform. Look for exchanges with high trading volumes and positive user reviews to ensure reliability.

Before making any transactions, set up a secure wallet to store your XEM safely. Avoid keeping large amounts of cryptocurrency on exchange platforms due to security risks.

Timing is crucial in the volatile world of crypto trading. Keep an eye on market trends, price fluctuations, and news related to NEM (XEM) to make informed decisions.

Consider using limit orders instead of market orders when purchasing XEM. This strategy allows you to set a specific price at which you want to buy, helping you avoid unexpected price changes.

Diversification is key – consider spreading your investments across different assets instead of going all-in on one coin like XEM. This can help mitigate risk and balance your portfolio effectively.

Risks and Security Measures

When it comes to buying XEM on P2B exchanges, there are risks that every investor should be aware of. One common risk is the possibility of hacking or security breaches on the exchange platform. It’s essential to choose a reputable exchange with strong security measures in place to safeguard your funds.

Another risk to consider is market volatility. The price of XEM can fluctuate rapidly, leading to potential losses if not monitored closely. Setting stop-loss orders and being cautious with your trading strategy can help mitigate this risk.

It’s crucial to be wary of phishing scams and fraudulent websites posing as legitimate exchanges. Always double-check URLs, enable two-factor authentication, and never share your private keys or passwords with anyone.

Educating yourself about the crypto market and staying updated on cybersecurity best practices is key to protecting your investments when buying XEM on P2B exchanges. Remember, proactive measures are essential in safeguarding your assets in the digital realm.

Conclusion

Buy XEM P2B exchanges can be a rewarding experience for investors looking to diversify their cryptocurrency portfolio. By understanding what XEM P2B is, the benefits of using such exchanges, factors to consider when choosing an exchange, top platforms in the market, tips for purchasing XEM, and risks associated with trading, you are better equipped to make informed decisions.

Remember that thorough research and due diligence are crucial before diving into the world of cryptocurrency trading. Stay updated on market trends and news related to NEM and XEM to make strategic investment choices.

With careful consideration and a proactive approach toward security measures, you can confidently navigate the realm of XEM P2B exchanges. Happy trading!

CRYPTO

Unlocking the Potential: Understanding WalletConnect là gì

With its groundbreaking innovations, WalletConnect is changing the game for consumers in the dynamic world of blockchain technology and decentralized applications (DApps). Here you will find the response to the question “WalletConnect là gì?” (meaning “What is WalletConnect?” in Vietnamese) if you have been seeking it. This detailed course will explore each component of WalletConnect, from its functionality to the ways it is changing the face of blockchain and cryptocurrency technology.

Understanding WalletConnect là gì

Customers may safely move money from their mobile wallet to their desktop browser with the use of WalletConnect, a decentralized technology. It integrates the two platforms, making it possible to engage seamlessly with various decentralized apps. With a concentration on transparency and centered around community development, the protocol’s structure is an open-source self-initiative.

How WalletConnect Works

Wallet Connect creates a safe connection between a user’s mobile wallet and a desktop or laptop browser through the utilization of QR code scanning when combined with encryption throughout the entire transaction. The following steps are usually involved in the process:

- Initialization: To begin, a code called a QR code is created when the user requests a connection using their computer’s browser.

- Scanning QR Code: When the user is prepared to pay, they may use their smartphone’s wallet app to photograph the QR code. After checking, end-to-end encryption is implemented to create the connection, which protects the user’s data and payments.

- Interaction with DApps: After the connection is set up, users may easily utilize their mobile wallet to engage with decentralized applications on their desktop browser.

Key Features of WalletConnect:

Decentralization

Firstly, WalletConnect is distributed, which means that no individual or party has power over all of it. This falls in line with the blockchain’s fundamentals, which aim at fostering user trust and protection.

Interoperability

WalletConnect’s main selling point is its capacity to link various wallets and apps. By enabling users to utilize their preferred wallet across several DApps, this interoperability greatly boosts user convenience.

Security

WalletConnect uses strong encryption technologies to prioritize security, which is critical in the cryptocurrency industry. During transactions, sensitive user data is protected by end-to-end encryption.

User-Friendly

WalletConnect streamlines the user experience by doing away with complicated settings, making it user-friendly number four. Everyone from crypto newbies to seasoned pros may utilize the QR code scanning method because of how simple it is.

Use Cases and Applications

A wide range of applications in the blockchain environment can benefit from WalletConnect’s adaptability:

Trading Platforms

Users may safely link their mobile wallets to decentralized exchanges, allowing for easy asset management and trading.

Gaming DApps

WalletConnect makes it straightforward to engage with digital applications for gaming, so users can engage in games built on the blockchain.

Defi Protocols

Thirdly, engage in decentralized finance (DeFi) protocols like crop production, lending, and refinancing while employing the WalletConnect protocol for added safety.

NFT Marketplaces

Integrating mobile wallets to digital currency (NFT) marketplaces is a crucial feature of WalletConnect, that enables users to easily purchase, sell, and exchange tokens that are indestructible.

Conclusion

WalletConnect certainly waves in the blockchain industry by removing impediments across multiple platforms and giving users peace of mind. When it comes to encouraging innovation while encouraging a decentralized tomorrow in the crypto WalletConnect is still at the top of the heap.

Anyone, from a seasoned crypto enthusiast to a complete blockchain novice, may benefit from WalletConnect’s ability to let them confidently and easily tap into an opportunity of decentralized apps. With all of this data, you may confidently answer the question, “WalletConnect là gì?” while contributing to the future of networked interactions.

FAQs

How does WalletConnect ensure the security of my private keys?

When setting up a connection, WalletConnect uses end-to-end encryption. The app never has access to the private key as it is kept in the user’s wallet. Using QR codes for connection further increases security by preventing sensitive data from being communicated over channels that might be hacked.

Can I use WalletConnect with any cryptocurrency wallet?

MetaMask, Trust Wallet, and MyEtherWallet are just a few of the many popular Bitcoin wallets that are compatible with WalletConnect. Most current wallets use this protocol to improve user experience, therefore check that your wallet supports it before joining.

How does WalletConnect handle multi-device scenarios?

The multi-device scenarios are where WalletConnect shines. Users won’t lose their connection even when they swap devices. Users can link their primary and secondary devices by scanning a QR code produced on the primary device when required. If you want to manage your cryptocurrency holdings on more than one platform, this flexibility is for you.

Are there any fees associated with using WalletConnect?

The protocol known as WalletConnect is both free and open-source. But consumers need to know that depending on the blockchain network they’re using, transaction fees might be applied. The relevant blockchain, and not WalletConnect, decide on these costs.

Can WalletConnect be used for non-financial applications?

Yes, WalletConnect can handle more than just monetary transactions. It has several potential uses in decentralized apps (dApps), such as gaming, social media, and identification applications. Because of its flexibility, WalletConnect may be used for more than just financial transactions.

Is WalletConnect compatible with mobile devices?

Sure, WalletConnect works great on mobile devices. Wallet integration with decentralized applications is possible on PC and mobile platforms. Users on the go will appreciate the increased accessibility of decentralized apps made possible by the QR code-based connecting technique.

CRYPTO

Mối Liên Hệ Giữa Blockchain và Web3: A Symbiotic Alliance

Mối Liên Hệ Giữa Blockchain và Web3: Blockchain and Web3 are two words that have increasingly come to the forefront of the constantly evolving IT scene. For success in the technological age of the future, recognizing how these two pillars relate to other ones is crucial.

Understanding Blockchain Technology

Transparent and distributed digital ledger technology is the essence of blockchain. The process of decentralized transparency and permanence are its core ideas. The attributes mentioned above ensure the security, honesty, and immutability of data, which is essential for building assurance in the online environment.

Evolution to Web3

The conceptual framework of the internet has gone through a shift in perspective with the move from Web2 to Web3. The distinctive features of Web3 include a concentration on the user, interoperability, and independence. Giving customers agency over their data and promoting application-to-application communications are two ways it empowers users.

Blockchain’s Role in Web3 Development

Web3 relies heavily on blockchain technology, which offers decentralized systems that do away with middlemen. To automate operations, increase efficiency, and decrease dependence on centralized authority, smart contracts automate the execution of agreements with their conditions encoded directly into code.

Interoperability in Web3

Integrating many apps and platforms seamlessly is one way blockchain helps with Web3’s interoperability. The result is a digital ecosystem that is more linked and collaborative since data and transactions can move freely between different platforms.

Decentralized Identity Management

A key component of the Web3 era made possible by blockchain is decentralized identity management. There is less opportunity for identity theft and other forms of illegal access since users are in charge of their own digital identities. Data stored on blockchain is more secure since it cannot be altered.

Tokenization and Web3 Economy

Essential to the Web3 economy is tokenization, or the transformation of asset rights into digital tokens stored on a blockchain. Promoting a more accessible and inclusive financial system, blockchain enables tokenomics, which in turn creates a token-driven economy. In this model, assets, services, and even government are represented by tokens.

Security Aspects in Web3

Web3 security is improved by blockchain technology’s cryptographic concepts and immutable ledgers. Security and integrity of digital transactions and data are guaranteed by blockchain because of its decentralized nature, which makes it resistant to hacker efforts.

Challenges and Solutions

While Web3 has many exciting features, one of the biggest obstacles is scalability. Problems with blockchain’s capacity to process high transaction volumes must be resolved. To make the Web3 ecosystem more efficient and scalable, sharding and other layer 2 technologies are being investigated.

Impact on Digital Ownership

An excellent illustration of how the use of blockchain technology and Web3 have impacted the evolution of digital ownership is the meteoric ascent of NFTs or Non-Fungible Tokens. A change in perspective has occurred in our understanding of and interaction with digital information as a consequence of NFTs, which represent having ownership of distinct digital properties.

Future Prospects

The prospect for blockchain and Web3 to keep trying to work together in the future looks very exciting. Fresh concepts are reshaping the internet, with possibilities including blockchain-based governance, decentralized banking (DeFi), and the realm of metaphysics.

Case Studies

Samples from real-world projects demonstrate how the use of blockchain technology has been effectively implemented into Web3 endeavors. Decentralized programs and communities built on the technology of blockchain are coming to fruition on platforms such as the Smart Chain on Binance, Polkadot, and the Ethereum network.

Community Engagement in Web3

The subsequent development of Web3 will be heavily influenced by involvement from the community. With the assistance of decentralized governance structures, open-source development, and joint endeavors, users are encouraged to assert ownership of the Web3 ecosystem and collaborate collaboratively to continue to keep it functional.

Educational Initiatives

To have blockchain and Web3 used by a lot of people, you need to get the word out. Helping people understand and adapt to this ever-changing technology world is the primary goal of educational programs including online classes, seminars, and community outreach.

Conclusion

Finally, Mối Liên Hệ Giữa Blockchain và Web3 is reshaping the digital world. Web3 technology, with its distributed ledger, transparency, and security features, is essential to promoting creativity, teamwork, and user agency.

FAQs

How does blockchain enhance security in Web3?

Due to its immutability and decentralized nature, blockchain technology improves cybersecurity and makes it harder to attack.

What is tokenization, and how does it drive the Web3 economy?

The process of tokenization, which creates a token-driven economy in Web3, entails turning asset rights into digital tokens on a blockchain.

What challenges does Web3 face, and how are they being addressed?

To improve efficiency, researchers are investigating sharding and layer 2 as potential solutions to the scalability problem in Web 3.

Can you provide examples of successful integration of blockchain in Web3 projects?

Examples of effective blockchain integration into projects developed by Web3 include platforms such as Binance Smart Chain, Polkadot, and the digital currency Ethereum.

How can individuals contribute to shaping the Web3 ecosystem?

One way consumers may contribute to the Web3 environment is by engaging with the wider community, participating in free and open-source work, or advocating democratic management models.

-

TECH8 months ago

TECH8 months agoExploring the Exciting Features of PHP Version 8.1 for Enhanced Web Development

-

CRYPTO4 months ago

CRYPTO4 months agoUnlocking the Potential: Understanding WalletConnect là gì

-

NEWS5 months ago

NEWS5 months agoBestadvise4u.com News: Your Gateway to Informed Living

-

ENTERTAINMENT5 months ago

ENTERTAINMENT5 months ago“кинокрадко” – Unmasking the Culprit Behind Film Piracy

-

TECH4 months ago

TECH4 months ago“몽세리 266b+v”: Revolutionizing Technology for a Better Future

-

HEALTH6 months ago

HEALTH6 months agoTough Tissue Muscle Connector: The Unsung Heroes of Movement

-

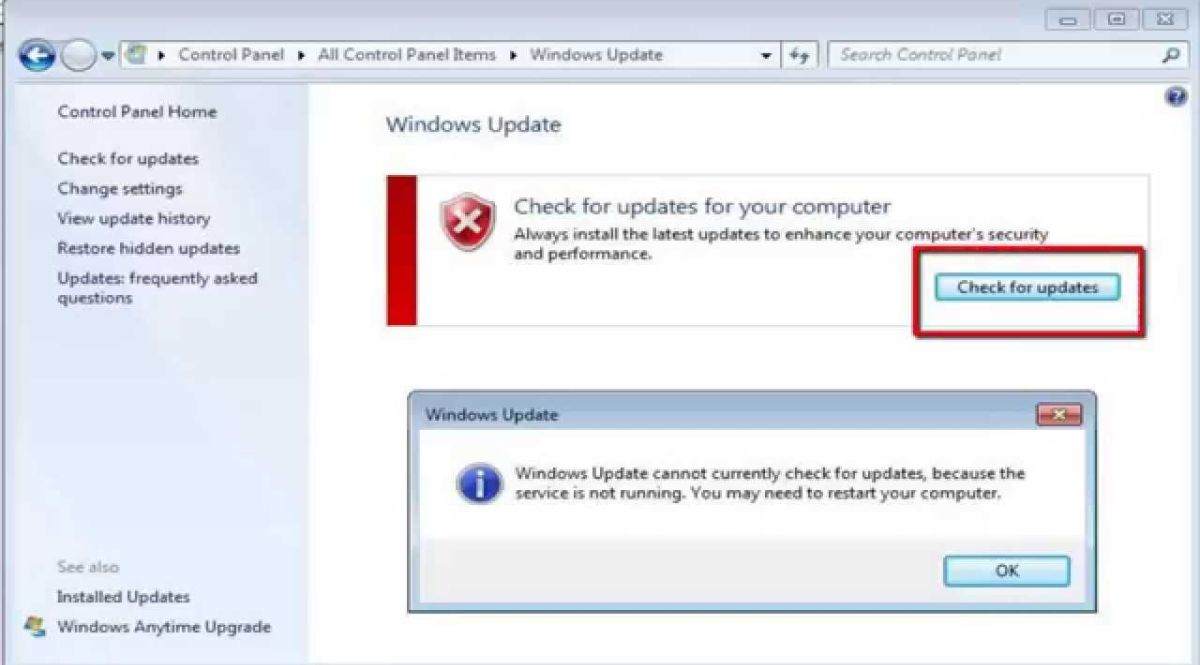

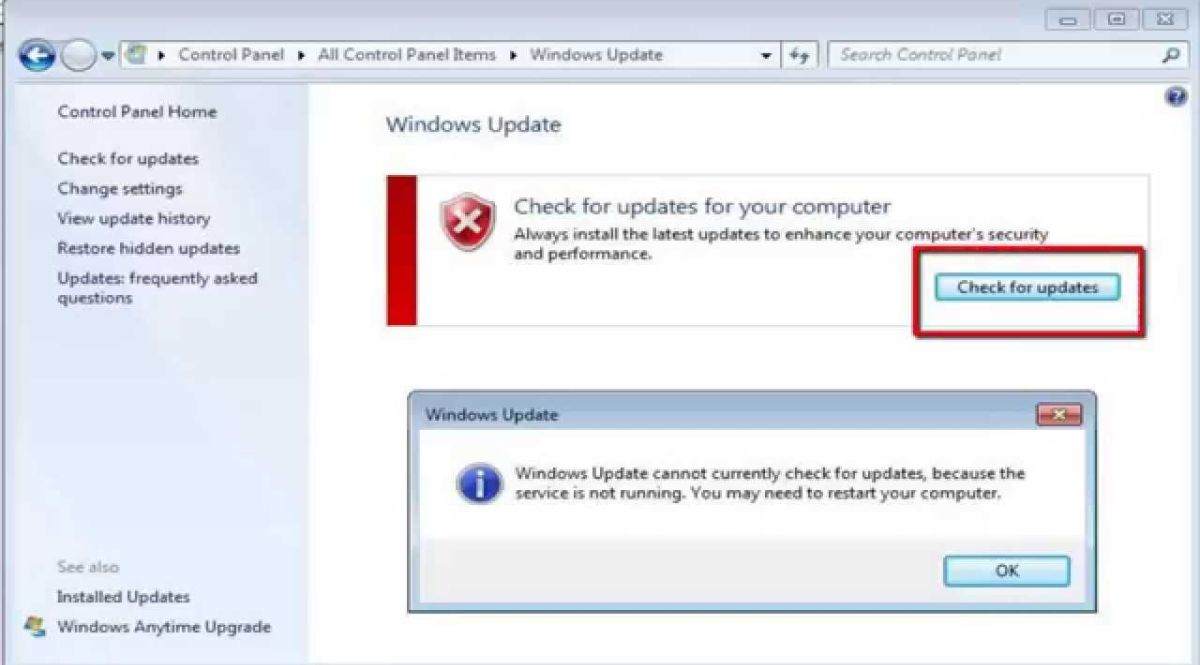

WINDOWS11 years ago

WINDOWS11 years ago(solved)-Windows update cannot currently check for updates, because the service is not running. You may need to restart your computer

-

WINDOWS9 years ago

WINDOWS9 years ago(Solved) – “How do you want to open this type of file (.js)?” Windows 8/8.1