HEALTH

Gain Health Insurance: Your Path to Secure Health and Peace of Mind

The significance of health insurance in today’s unstable environment is difficult to overestimate. Preserving one’s mental and physical well-being requires a safety net, and health insurance might offer just that. In this detailed tutorial instruction, we’ll delve into “Gaina Health Insurance” and explain why it should be a top priority for you and those who love you.

Introduction

Safeguarding one’s health should be a top priority considering it is the most important asset that we have. You may rest easy understanding that you and your loved ones will have protection for hospitalization when you need it most with the backing of Gaina Wellness Insurance. What follows is an in-depth look of Gaina Health Insurance, designed to help you understand the terminology, examine the features, and make educated choices.

Understanding Gaina Health Insurance

What is Gaina Health Insurance?

Gaina Health Insurance is a form of protection that helps pay for medical care out of pocket. In exchange for your regular premium payments, the insurance company agrees to assist pay your covered medical expenses should the need arise.

Why is Health Insurance Essential?

Having health insurance is like having a safety net, sheltering you from the financial burden of unplanned medical care. You shouldn’t have to stress about money while you’re sick or hurt. You can get the care you need without worrying about how to pay for it thanks to Gaina Health Insurance.

Benefits of Gaina Health Insurance

Comprehensive Coverage

Coverage under Gaina Health Insurance extends to a wide range of medical services, from emergency room visits and hospital stays to prescription drugs and wellness checkups. You may rest certain that you will have access to a comprehensive selection of medical care options with this level of protection.

Financial Security

Gaina Health Insurance’s emphasis on financial safety nets is a key selling point. You may put more of your attention into getting better while your health insurance takes care of the financial aspects of a medical emergency.

Access to Quality Healthcare

Gaina Health Insurance gives you access to a large group of doctors and hospitals so that you may be confident in the care you receive. Having this kind of convenience is crucial when looking for expert care and consultations.

Types of Gaina Health Insurance Plans

Gaina Health Insurance provides a range of options to meet your specific requirements:

Individual Health Insurance

For those who only need coverage for themselves, there are “individual plans” that can help.

Family Health Insurance

Plans that cover everyone in a family may save individuals and families a lot of money.

Group Health Insurance

Many companies provide their workers with access to group insurance at a discounted rate. They guarantee a safe and healthy workplace for all employees.

Choosing the Right Gaina Health Insurance Plan

Assessing Your Healthcare Needs

Determine what kinds of medical treatment you’ll need and how much you can afford before settling on a Gaina Health Insurance plan.

Comparing Plans and Providers

You need to look into your options and compare plans and companies to pick one that meets your needs. Things to think about include insurance, access to a network of doctors, and feedback from existing customers.

The Application Process

Eligibility Criteria

The requirements for participation in each Gaina Health Insurance plan are different. Be sure you qualify by reading the requirements carefully.

Required Documentation

Get your identification and medical records ready to submit with your Gaina Health Insurance application.

Understanding Premiums and Deductibles

Premiums Explained

Insurance premiums are the regular payments made to the insurance provider to keep coverage in effect. Plan specifics may affect the final sum.

Deductibles Demystified

You will often have to pay a deductible before your insurance will begin to pay anything. One of the most important aspects of healthcare expense management is knowing your deductible.

Making Claims with Gaina Health Insurance

Step-by-Step Claim Process

Learn the specifics of filing a claim with Gaina Health Insurance in advance to lessen the stress of dealing with a medical emergency.

Common Claim Mistakes to Avoid

Common blunders that might cause claims to be denied or delayed should be avoided. Here are some pointers to assist you successfully file a claim.

Maintaining Your Health Insurance

Premium Payments

Make sure your Gaina Health Insurance stays in effect by paying your premium on time. We can help you figure up a system for handling your money.

Renewal of Policies

Learn the steps involved in renewing your insurance so that you can be assured that your medical expenses will be covered.

Conclusion

Gaina Health Insurance is a means to an end—one that’s brighter and more secure health. You can better protect your health and your finances by taking charge of your insurance situation and learning everything you can about the many options available to you.

FAQ’s

- What is the waiting period for pre-existing conditions?

- The waiting period for pre-existing illnesses varies per plan with Gaina Health Insurance. Be sure to go through the fine print of your policy.

- Can I add family members to my individual plan?

- Adding family members to your individual plan is often allowed by Gaina Health Insurance companies, giving you peace of mind that everyone in your immediate family is covered.

- Are there any tax benefits to having health insurance?

- There are tax breaks or exemptions for those who have medical coverage in a number of nations. If you want to know the nuances of the tax code in your area, you should talk to a tax expert.

- What happens if I miss a premium payment?

- A gap in coverage may occur if premium payments are missed. Paying your health insurance premiums on time is very important.

- How can I upgrade my coverage?

- In many cases, contacting your Gaina Health Insurance provider and outlining your needs might result in an increase in your coverage. They will help you through it step by step.

HEALTH

Exploring the Benefits of Eye-Ta: A Comprehensive Guide

Are you looking to see the world with crystal-clear vision? Dive into the realm of Eye-Ta, a natural solution that has been revered for centuries. Join us on a journey to explore the wonders and benefits of Eye-Ta, a holistic approach to enhancing not just your eyesight but also your mental clarity. Let’s unravel the secrets behind this ancient remedy and discover how it can transform your daily life for the better.

Understanding the Benefits of Eye-Ta for Vision Health

Have you heard about the ancient practice of Eye-Ta and its remarkable benefits for vision health? This traditional technique focuses on exercises and movements specifically designed to strengthen eye muscles, improve focus, and enhance overall visual acuity. By incorporating Eye_Ta into your daily routine, you can potentially reduce eye strain from prolonged screen time or reading.

One of the key advantages of practicing Eye_Ta is its ability to alleviate symptoms of digital eye strain caused by excessive use of electronic devices. These simple yet effective exercises can help relax tired eyes, prevent dryness, and promote better circulation in the eye area.

Moreover, regular practice of Eye_Ta has been linked to improved concentration and mental clarity. As our eyes are closely connected to our brain function, enhancing visual health through Eye-Ta exercises may also support cognitive performance and productivity in daily tasks.

Whether you’re looking to maintain healthy vision or seeking relief from digital eye strain, exploring the benefits of Eye-Ta for vision health could be a transformative addition to your wellness routine.

The Connection Between Eye-Ta and Mental Clarity

Have you ever wondered about the link between your vision health and mental clarity? Eye-Ta, a traditional holistic practice, is believed to not only benefit your eyes but also enhance your cognitive function. The eyes are often referred to as the windows to the soul, but they also play a crucial role in how we perceive and process information.

By incorporating Eye_Ta into your daily routine, you may experience improved focus and concentration. Clear vision can lead to sharper cognitive abilities, allowing you to think more clearly and efficiently. When our eyes are strained or fatigued, it can impact our overall mental well-being.

Research suggests that maintaining healthy vision through practices like Eye_Ta can positively influence brain function. Just as physical exercise benefits both body and mind, taking care of our eye health can contribute to enhanced mental clarity. Consider exploring the connection between Eye-Ta and mental acuity for a holistic approach toward optimal well-being.

Incorporating Eye-Ta into Your Daily Routine

Are you looking to enhance your vision health and mental clarity naturally? Consider incorporating Eye-Ta into your daily routine. Start by introducing a few drops of Eye_Ta into your morning routine, whether in your morning tea or water. The subtle earthy taste blends seamlessly with beverages.

Try adding a drop of Eye-Ta on the inside of your wrist for quick absorption throughout the day. This simple act can help maintain focus and visual acuity during work or study sessions. Carrying a small bottle of Eye_Ta in your bag allows for easy access whenever needed.

Incorporating Eye_Ta into meditation practices can also amplify its benefits for mental clarity. A few deep breaths infused with the aroma of Eye_Ta can create a calming effect, aiding in relaxation and concentration. Experimenting with different ways to include Eye-Ta in your daily rituals can lead to noticeable improvements in overall well-being over time.

Exploring Other Uses of Eye-Ta Beyond Vision Health

Eye-Ta, a powerful herb known for its benefits to vision health, offers more than just improved eyesight. Beyond its primary function in supporting eye health, Eye_Ta has been recognized for its potential to promote overall well-being.

In traditional medicine practices, Eye-Ta has been used not only for vision-related issues but also as a remedy for digestive problems and respiratory concerns. Its natural properties are believed to help with inflammation and support immune system functions.

Moreover, some studies suggest that Eye_Ta might have calming effects on the mind and body, potentially aiding in reducing stress levels and promoting mental clarity. This dual-action benefit makes Eye_Ta a versatile herb worth exploring beyond its initial association with eye health.

Whether consumed as part of a daily supplement routine or brewed into teas, the diverse applications of Eye-Ta showcase its versatility in supporting various aspects of health and wellness.

Potential Side Effects and Precautions

When exploring the benefits of Eye-Ta, it’s essential to also consider potential side effects and precautions. While Eye_Ta is generally safe for most people, like any supplement or health product, there are a few things to keep in mind.

Some individuals may experience mild digestive issues like bloating or gas when first incorporating Eye_Ta into their routine. It’s recommended to start with a lower dosage and gradually increase to allow your body to adjust.

As with any new supplement, it’s always wise to consult with a healthcare professional before adding Eye_Ta to your daily regimen, especially if you have existing medical conditions or are pregnant or nursing.

It’s important not to exceed the recommended dosage of Eye_Ta as this could lead to adverse effects. Always follow the instructions provided on the packaging and listen to your body’s response.

By being aware of these potential side effects and taking necessary precautions, you can enjoy the benefits of Eye-Ta safely and effectively.

Conclusion

Considering the numerous benefits Eye-Ta offers for vision health, mental clarity, and overall well-being, it is worth trying. Incorporating this ancient practice into your daily routine can potentially enhance your quality of life in various ways. Remember to start with small steps and observe how Eye_Ta positively impacts your physical and mental health over time. Embrace the power of Eye-Ta and experience its transformative effects on your holistic well-being.

HEALTH

Setriasona: Unique Pharma Insights

Setriasona has made a name for itself in the cutting-edge pharmaceutical industry by offering ground-breaking remedies for a range of medical issues. This article will examine Setriasona in great detail, including its definition, characteristics, advantages, and distinctive qualities that make it stand out from competitors.

What is Setriasona?

A medication called sestriasona is well-known for its many uses in the medical industry. Originating from state-of-the-art research, it has attracted notice due to its unique qualities and possible influence on health and overall well-being.

Key Features of Setriasona

The versatility of Setriasona is one of its best qualities. In contrast to conventional drugs, Setriasona uses a multimodal strategy to treat a range of medical conditions. Its distinct composition and formulation add to its effectiveness, which puts it at the forefront of the pharmaceutical industry.

Benefits of Setriasona Usage

Setriasona users claim a variety of advantages, including increased general well-being and cognitive performance. It is a sought-after remedy for people wishing to address a variety of health issues without having to deal with the side effects that are sometimes connected to conventional pharmaceuticals because of their adaptogenic qualities.

4. How Setriasona Works

[Details on the metabolic processes] are the mechanism behind Setriasona. Setriasona stands out from other medications due to its novel methodology, which guarantees desired outcomes while reducing side effects.

Comparing Setriasona with Alternatives

Although there are many competitors on the market, Setriasona is unique due to [certain benefits]. This section aims to offer a thorough comparison so that customers may make well-informed decisions regarding their health.

Setriasona in Medical Research

Setriasona is essential to medical research, and the pharmaceutical industry is undergoing a paradigm change as a result. Its prospective uses in [name particular areas] are being investigated by researchers, perhaps leading to new developments in healthcare.

User Testimonials

Experiences from the real world tell a story. Individuals who have included Setriasona in their daily regimens report more energy, better attention, and a general feeling of well-being. These testimonies give important context for understanding the real-world advantages of Setriasona.

Potential Side Effects

Although most people handle setriasona well, it’s important to be informed of any possible adverse effects. It’s important to speak with a healthcare provider for specific guidance, as typical side effects might include [list common side effects].

Dosage and Administration

It is crucial to follow the advised dose and administration directions for the best outcomes. The recommended dose, recommended administration techniques, and any other user-related issues will all be included in this section.

Setriasona in the Market

The environment of the Setriasona market is changing quickly. Its increasing appeal is a result of industry collaborations, consumer trends, and legislative advancements. Keep checking back as we examine the factors influencing Setriasona’s market share.

Research and Development

Exciting opportunities arise as Setriasona research advances. Aiming to uncover new potentials and improve current formulations, ongoing research promises improvements that have the potential to completely change the pharmaceutical industry.

Conclusion

To sum up, Setriasona is a promising development in the pharmaceutical industry. It is positioned as a significant option for individuals looking for healthcare alternatives because of its distinctive features, pleasant user experiences, and continuous research.

FAQs

Is Setriasona safe for long-term use?

Although typically well tolerated, for tailored guidance on long-term use, it is best to speak with a healthcare provider.

Can Setriasona be taken with other medications?

To avoid possible drug interactions, always speak with a healthcare professional before using Setriasona with other prescriptions.

Are there age restrictions for Setriasona use?

Adults using setriasona are generally safe, yet there may be certain age-related restrictions. Speak with a medical expert for direction.

How quickly can one expect to see results with Setriasona?

The outcomes might differ, thus it’s important to allow Setriasona enough time to show its effects. Individual reactions vary depending on lifestyle and health conditions.

Where can Setriasona be purchased?

Online merchants or authorized stores may carry Setriasona. Make sure the sources from which you are buying are reliable.

HEALTH

Unlocking Your Well-being: A Dive into 10desires.org Health

In the modern world, people of all ages have chosen to make it their top priority to take care of their health and well-being. The landscape of healthcare and health services remains constantly changing, so individuals must remain up-to-date and make use of tailored online resources. In this post, we’ll take a look at every possible manner in which 10desires.org Health might help you improve your health. Prepare to go off on a path that promotes better healthcare.

Navigating the 10desires.org Health Portal

What Is 10desires.org Health?

10desires.org Health is built on a robust platform that aims to improve people’s health in all areas. If you have any questions or need any services about your health, go no further than our online hub.

The 10 Pillars of Wellness

Find out what 10desires.org Health prioritizes to improve your health as a whole. Each pillar, which ranges from diet and exercise to mental health and preventative treatment, is intended to give you more control over your health.

Personalized Health Assessments

Learn about the value of personalized health evaluations that can shed light on your specific health situation. 10desires.org Health tailors its advice and assistance to each individual by taking into account their unique wants and requirements.

Health and Lifestyle Blogs

Expert-Authored Articles

Check out this wealth of articles written by experts in the field of health care. Various health-related subjects are explored here, with helpful insights, suggestions, and guidance provided.

User-Generated Content

Participate in the conversation by reading testimonials from people whose lives have been improved because of the resources provided by 10desires.org Health. Find others with similar health goals and connect with them.

Interactive Health Tools

Fitness Tracker

Use a smart fitness tracker to monitor your development as an exerciser. Get in shape by planning your strategy, keeping track of your progress, and maintaining your enthusiasm.

Meal Planner

Use the meal planner to organize your meals with pinpoint accuracy. Get meal plans tailored to your tastes and health objectives.

10desires.org Health Membership

Premium Benefits

Learn about the exclusive benefits that members of 10desires.org Health enjoy. Benefits for members range from preferential scheduling with doctors to price reductions on health and fitness supplies.

Community Support

Come together with others who value health and wellness as much as you do and find mutual support. Engage with people, get their input on your health journey, and be an inspiration to others.

Conclusion

To live a better and happier life, 10desires.org Health is more than simply a website. This platform gives you the tools, knowledge, and community you need to improve your health on your terms. Use 10desires.orgHealth as the starting point for your path to a better self.

FAQ’s

Is 10desires.org Health suitable for all age groups?

Absolutely! 10desires.orgHealth serves people of all ages by providing them with individualized information and assistance.

Are the personalized health assessments accurate?

The goal of individualized health evaluations is to give you reliable information about your health status so you may make educated decisions.

How can I contribute my own health story to the platform?

Creating a user account and presenting your health journey using the given channels on 10desires.org Health is a simple way to help others.

What benefits can I expect as a premium member?

Access to medical professionals, exclusive offers, and higher membership status are just some of the perks enjoyed by premium members.

Is 10desires.orgHealth accessible on mobile devices?

Keeping in touch and up-to-date when on the road is a breeze thanks to the mobile-friendly design of 10desires. or health.

-

TECH8 months ago

TECH8 months agoExploring the Exciting Features of PHP Version 8.1 for Enhanced Web Development

-

CRYPTO4 months ago

CRYPTO4 months agoUnlocking the Potential: Understanding WalletConnect là gì

-

NEWS5 months ago

NEWS5 months agoBestadvise4u.com News: Your Gateway to Informed Living

-

ENTERTAINMENT5 months ago

ENTERTAINMENT5 months ago“кинокрадко” – Unmasking the Culprit Behind Film Piracy

-

TECH4 months ago

TECH4 months ago“몽세리 266b+v”: Revolutionizing Technology for a Better Future

-

HEALTH6 months ago

HEALTH6 months agoTough Tissue Muscle Connector: The Unsung Heroes of Movement

-

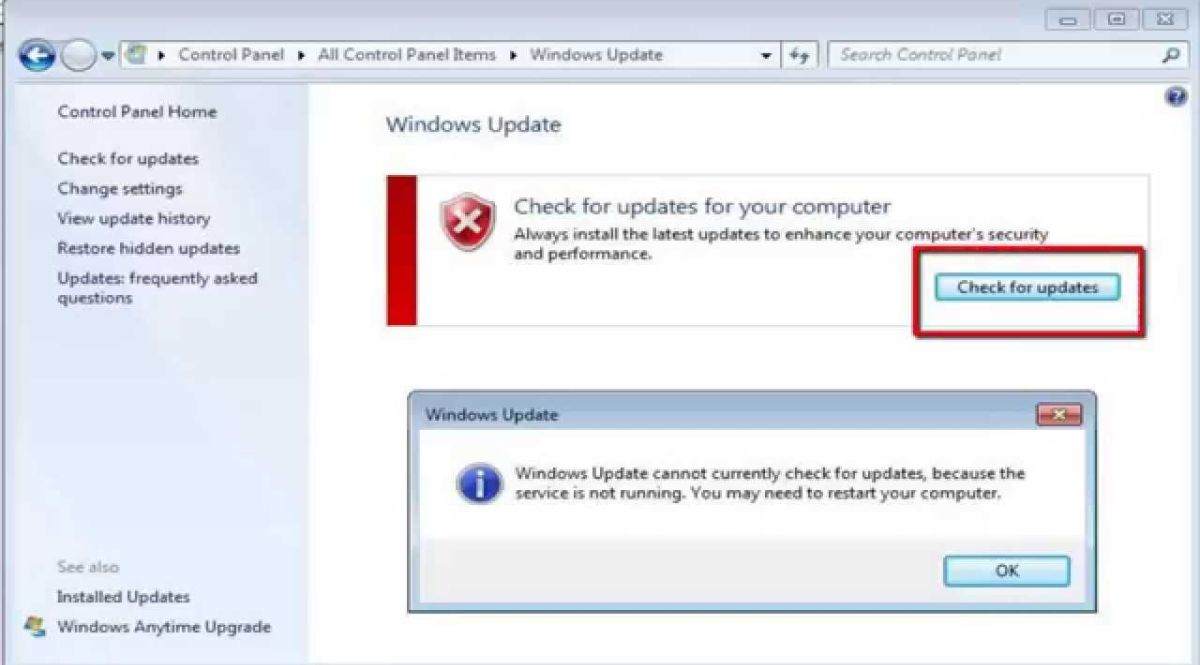

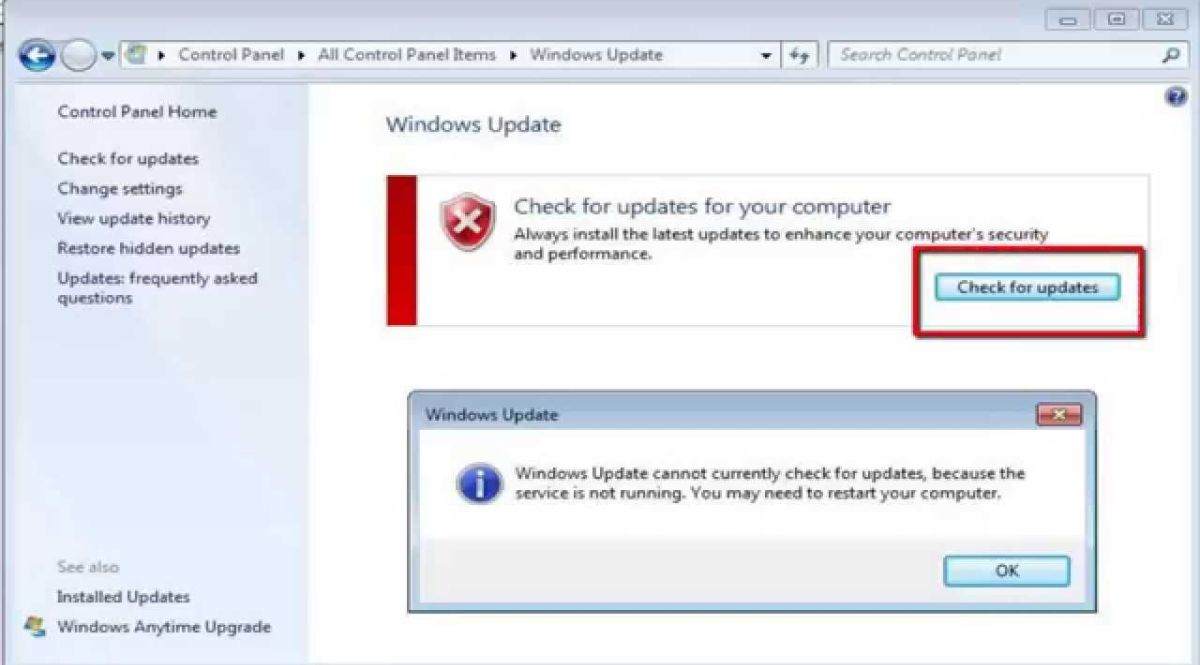

WINDOWS11 years ago

WINDOWS11 years ago(solved)-Windows update cannot currently check for updates, because the service is not running. You may need to restart your computer

-

WINDOWS9 years ago

WINDOWS9 years ago(Solved) – “How do you want to open this type of file (.js)?” Windows 8/8.1