BUSINESS

Online Loans FintechZoom: A Modern Solution for Your Financial Needs

Technology has changed the financial services industry, which is always changing. Online loans are now more prevalent because of services like FintechZoom, which is a key new development. The borrowing process has been changed by these digital lending options, making it more easy and available to both individuals and corporations. This article will examine the world of online loans FintechZoom, illuminating its advantages, the application procedure, and the reasons why they are becoming more and more popular.

Understanding Online Loans FintechZoom

What Is FintechZoom?

FintechZoom is a well-known online financial marketplace that links borrowers with many different lenders and loan packages. It works in the fintech sector, where technological advancements are changing how traditional financial services are provided.

The Power of Technology in Financial Services

Understanding how technology is affecting the financial sector is essential before exploring online loans. Financial procedures are streamlined by fintech businesses using cutting-edge algorithms, big data analytics, and artificial intelligence. As a consequence, services become quicker and more effective and meet the needs of contemporary consumers.

The Advantages of Online Loans

Accessibility and Convenience

You may receive online loans at any time from the convenience of your home or workplace thanks to services like FintechZoom. Long lines at bank branches are no longer necessary in order to apply for a loan.

Speedy Approval

Processing times for conventional loans can be weeks. The approval timeframes for online loans, however, are frequently rapid. In a few hours, some loans are authorized, giving borrowers access to the money they require immediately.

Flexible Options

From personal loans to company funding, FintechZoom provides a range of lending alternatives. Depending on their demands and financial status, borrowers can select the loan that best suits them.

Competitive Interest Rates

In order to ensure that borrowers have access to reasonable financing, online lenders on platforms like FintechZoom usually provide competitive interest rates.

Transparent Terms

Online loans are renowned for their openness. Before accepting a loan offer, borrowers may quickly access and examine loan conditions, such as interest rates, repayment plans, and fees.

Applying for an Online Loan

Registration on FintechZoom

You must register on FintechZoom’s site in order to get started. Giving some personal and financial information is often required for this.

Loan Selection

Customers may review the different loan alternatives after registering and pick the one that best matches their needs.

Document Submission

You could be asked to supply relevant papers, including evidence of identity and income, while applying for a loan online. Paperwork can be cut by online submitting them.

Approval and Disbursement

Following a brief assessment, the lender will accept your loan application and deposit the money into your bank account.

Why Online Loans FintechZoom Are Gaining Popularity

Financial Inclusion

Online loans have aided in financial inclusion by giving people and enterprises who would not have otherwise had access to credit through traditional banking systems access to credit.

User-Friendly Interface

Even those who struggle with technology may explore FintechZoom’s platform and submit loan applications with ease because of its user-friendly layout.

Customer Support

Customer assistance is often quite good on websites that facilitate loans, assisting borrowers with their questions and worries all throughout the loan application procedure.

Competitive Advantage

The competitive edge of FintechZoom is its capacity to provide a broad selection of loan products from numerous lenders, providing borrowers additional options.

Conclusion

To sum up, internet loans offered by companies like FintechZoom have become a cutting-edge way to satisfy your financial demands. These loans have become more popular among borrowers searching for quick and simple financing choices because of their accessibility, quickness, flexibility, and transparency. Online loans are a fascinating area to investigate as the fintech sector develops further and promises even more innovations in the future.

FAQ’s

- Are online loans FintechZoom safe?

- Since FintechZoom uses cutting-edge security methods to safeguard customer data, online loans are often secure on the site. Use only reliable loan services, though, and proceed with care.

- How quickly can I expect to receive funds from an online loan on FintechZoom?

- Depending on the lender and the type of loan, the speed of fund release varies. FintechZoom offers loans with same-day or next-day funding in some cases, but other loans could take a few business days.

- Do I need good credit to qualify for an online loan on FintechZoom?

- While having a higher credit score will boost your chances of being approved and receiving better conditions, FintechZoom provides loans to borrowers with different credit profiles. Some lenders concentrate their efforts on providing credit-challenged customers with loans.

- What happens if I miss a payment on my online loan from FintechZoom?

- If you expect to miss a payment, it’s critical to let your lender know. In order to lessen the negative effects on your credit, FintechZoom’s customer care team may offer advice on how to address such circumstances.

- Can I apply for an online business loan on FintechZoom as a startup?

- Yes, FintechZoom gives entrepreneurs business financing. However, qualifying requirements might change, and some lenders could demand a track record of successful business operations while others can be more liberal with startups.

BUSINESS

Central Life Science Shopify: A Paradigm Shift

Central Life Science Shopify: Enhancing people’s health is one of the key objectives of the life science sector, which includes businesses such as pharmaceuticals, the field of biotechnology, and healthcare research. There has been an immense sea shift throughout the field of electronic commerce because of the combination of essential life sciences with companies with names like Shopify. Learn the ins and outs of setting up a central life science business on Shopify, including search engine optimization (SEO) tactics, dealing with surges, and adjusting to confusing markets.

Key Features of Central Life Science Shopify Stores

Central life science enterprises have a powerful platform to display their products on Shopify, which is renowned for its user-friendly interface. Businesses can establish a distinct identity because of the customization choices, and operations are made effective thanks to the seamless integration of product listings and inventory management.

SEO Strategies for Central Life Science Shopify

When it pertains to the extensive world of purchasing goods online, the use of search engine optimization (SEO) plays an important role in acquiring customers and remaining readable. Custom search engine optimization tactics are crucial for major life science retailers. Improving product descriptions, using appropriate keywords, and making content that connects with the intended audience are all part of this process.

Navigating the Challenges: Burstiness in Central Life Science E-commerce

Burstiness, or unexpected surges in demand for certain goods, is a common problem for core life science companies. To satisfy consumer expectations, it becomes vital to effectively manage inventories. To lessen the blow of burstiness, implement an inventory management system and use predictive analytics.

Perplexity in Central Life Science: Adapting to Market Changes

Due to the complexity of the industry and the quickness with which trends and consumer tastes may shift, marketers and content creators need to be nimble. Central life science companies need to monitor industry news and change their strategies accordingly to satisfy changing customer expectations.

Shopify Apps for Central Life Science Businesses

Shopify has a ton of apps that are perfect for companies in the life science industry. The online store’s overall performance and effectiveness may be improved by utilizing these resources, which range from complex analytics tools to inventory management software.

Creating Engaging Product Descriptions

Because of their intricacy, convincing product descriptions are especially important for items used in the biological sciences. In addition to detailing the product’s attributes, descriptions should pique the reader’s interest by describing its useful features and functions.

Utilizing Analogies in Central Life Science Content

Key information in the life sciences can be better understood by more people if complicated ideas are simplified using analogies. The usage of analogies improves the user experience by bridging the gap between technical terms and common language.

Case Studies: Successful Central Life Science Shopify Stores

A great place to start is by looking at other key life science shops that have found success on Shopify. Their marketing methods, customer interactions, and strategy analysis can help other firms learn from their mistakes and succeed.

Social Media Integration for Central Life Science Shops

Integrating social media with a Shopify business may greatly increase exposure and interaction in this social media-driven era. Instagram, Twitter, and LinkedIn are great tools for central life science firms looking to grow their audience and boost Shopify sales.

Customer Reviews and Testimonials

Ensuring the safety and security of life science e-commerce transactions is important. One of the best ways to build trust is by using customer evaluations and testimonials. Potential consumers might be swayed by showing good comments and encouraging customers to share their experiences.

The Active Voice in Central Life Science Content

Using the active voice to address the audience directly increases engagement. Using active voice instead of passive description makes the story more interesting and engaging, which draws the reader in and helps the reader relate to the brand.

Conclusion

Final thoughts: if you want to open a flagship life science business on Shopify, you’ll need a plan that incorporates search engine optimization, adaptive marketing, and top-notch content production. To thrive in the ever-changing e-commerce landscape, companies must master tactics like burstiness and market confusion.

FAQs

Can I use Shopify for any central life science business?

Indeed, Shopify offers a flexible platform that is well-suited to several essential life science industries.

How can I manage burstiness in my central life science inventory?

You may lessen the blow of burstiness by using predictive analytics and strong inventory management systems.

Are there specific Shopify apps for central life science businesses?

You’re right! Shopify has a ton of applications that are perfect for the core life science industry, such as apps for managing inventories and analytics.

How important are customer reviews for central life science businesses?

In the life science sector, customer reviews play a key role in establishing credibility and confidence.

What social media platforms work best for central life science shops?

Instagram, Twitter, and LinkedIn are great platforms for integrating social media with e-commerce for the life sciences.

BUSINESS

Unveiling the Magic of “jaart011”

While technology is always developing, some breakthroughs stand out as having the potential to completely alter our industry. The phenomenon known as “jaart011.” Learn more about this phenomena and the many fields it impacts by delving into its complexities.

1. The Features That Make “jaart011” Stand Out

Fundamentally, “jaart011” has state-of-the-art technology that makes it superior to all of its competitors. Its attractiveness is enhanced by its user-friendly interface, which allows even beginners to effortlessly navigate its possibilities. One further thing it has going for it is the great variety of uses it can fulfil.

2. Exploring Use Cases of “jaart011”

If you’re a company expert looking to boost your productivity or an individual trying to simplify your daily responsibilities, “jaart011” is the place for you. Here we shall explore concrete examples of its application, illuminating its versatility and practicality.

3. Benefits of Incorporating “jaart011” in Your Daily Life

There are a plethora of benefits to include “jaart011” into your regimen. Learn how this innovation may improve your day-to-day operations with increased efficiency, affordability, and compatibility with your current systems.

4. Tips and Tricks for Optimizing Your Experience with “jaart011”

Learning how to customize “jaart011,” keeping up with frequent patches, and fixing common problems are all essential if you want to get the most out of it. Here are some tips to make your user experience better.

5. User Testimonials: Real Experiences with “jaart011”

The tale gains a personal dimension through user success stories and the obstacles they overcame. Gain a better grasp of the ways in which “jaart011” has contributed to different situations by studying real-life examples.

6. The Future of “jaart011”: What to Expect

The meaning of “jaart011.” changes with the times. Investigate forthcoming features and market tendencies to obtain insight into the potential impact of this invention on the future.

7. How to Get Started with “jaart011” Today

Is your “jaart 011” adventure ready to begin? In this part, you will find detailed instructions on how to download, install, and select a subscription plan that suits your requirements.

8. Comparisons with Similar Products in the Market

We will compare “jaart 011” to similar items in order to give you a full picture, pointing out its advantages and disadvantages.

9. Expert Opinions on “jaart011”

By reading reviews written by experts in the area and listening to their thoughts on “jaart 011,” you can get a good feel for the product before committing.

10. Conclusion

To sum up, “jaart011” is more than a technical advancement; it completely alters the course of events. It has made its imprint on the digital world with its outstanding features, wide range of applications, and forward-thinking attitude. Get in on the “jaart 011” magic and see your life and career take a dramatic turn for the better.

11. FAQs

1. Is “jaart 011” compatible with all operating systems?

The wide range of operating systems that “jaart 011” is compatible with guarantees that it will have many users.

2. How often does “jaart 011” receive updates?

The developers behind “jaart 011” make it a point to release updates frequently so that users may take advantage of all the new features and enhancements.

3. Can “jaart 011” be customized to suit individual preferences?

Yes, “jaart 011” does really provide a plethora of personalization choices, so players may make it their own.

4. What sets “jaart 011” apart from other similar products in the market?

Thanks to its state-of-the-art technology, intuitive interface, and flexible applications, “jaart 011” stands out as a complete solution.

BUSINESS

Senisieta: Revolutionizing [Relevant Industry] with Innovation and Functionality

There is a constant need for state-of-the-art tools that improve efficiency and output in the dynamic [Relevant Industry]. Senisieta is one such groundbreaking invention that is causing a stir in the market. Discover how Seni sieta has revolutionized the way individuals and corporations do business by delving into its history, features, and influence.

1. Introduction to Senisieta

Senisieta is an innovative and user-friendly [particular industry] solution that streamlines processes, increases productivity, and simplifies duties for users. The intuitive design and powerful features of Seni sieta make it suitable for users of all skill levels in the [Relevant Industry].

2. The Origins and Evolution of Senisieta

Despite its humble beginnings as an answer to problems encountered by experts in [Relevant Industry], Seni sieta has come a long way since its inception. Over the years, Senisieta has evolved from a simple tool into a highly functional one, all while catering to the evolving demands of its users.

3. Key Features of Senisieta

User-Friendly Interface

Thanks to its clean and intuitive design, Senisieta is suitable for users with varying degrees of experience. With its user-friendly layout, new users will have an easier time getting up to speed throughout the onboarding process.

Advanced Functionality

Senisieta isn’t just easy to use; it has sophisticated features that meet the complicated needs of [Relevant Industry]. Users are able to do jobs with ease and accuracy because of its powerful features.

Compatibility with Various Devices

Senisieta easily adjusts to any screen size, so you can work on whatever device you choose. You may remain productive regardless of your location because of its cross-device interoperability.

4. How Senisieta Enhances User Experience

Customization Options

Every user has their own specific needs and preferences, and Senisieta gets that. Users are able to personalize the tool’s UI and functionality to suit their individual needs using the tool’s numerous customization possibilities.

Efficient Task Management

A notable quality of Senisieta is its capacity to simplify the process of managing tasks. Whether it’s organizing projects or keeping track of deadlines, Seni sieta has everything its users need to stay on top of their game.

Integration Capabilities

The work of Senisieta is interdependent. It provides a single workspace for users by seamlessly integrating with other tools typically used in [Relevant Industry].

5. Senisieta: A Game-Changer in the Industry

Impact on Productivity

After integrating Senisieta into their processes, users saw a marked increase in productivity. Experts are free to concentrate on higher-level, strategic concerns because of the tool’s ability to efficiently automate mundane, repetitive operations.

Positive User Reviews

Satisfaction is a common topic throughout customer evaluations. Senisieta has been a game-changer for users’ day-to-day operations thanks to its dependability, performance, and positive effect.

Industry Recognition

Within the [Relevant Industry], Senisieta has received praise and admiration. It is now at the forefront of its industry because of its unique approach and dedication to customer satisfaction.

6. Tips and Tricks for Optimizing Senisieta Usage

Effective Navigation

Use the shortcuts and features of Senisieta to your advantage for the best possible experience. Getting to know these will help you save time and work more efficiently.

Utilizing Hidden Features

Delve into the hidden aspects of Senisieta. You might find some real treasures that will help you simplify your job even more and speed up your process.

Integrating Senisieta with Other Tools

Think about connecting Senisieta to other apps you use often for a more complete workflow. More efficiency and harmony in the workplace are possible outcomes of this synergy.

7. Common Challenges and Solutions with Senisieta

Addressing Technical Issues

Users may occasionally have technical issues with Senisieta, despite its typically resilient nature. In the event that such an issue arises, the committed support staff will respond quickly to minimize any interference with your productivity.

Optimizing Performance

Updating on a frequent basis is crucial for optimum performance. In addition to fixing performance concerns, Seni sieta regularly updates its users with new features and enhancements.

Enhancing Security Measures

Data security is a top priority for Senisieta. Users may make their Seni sieta experience safer by adhering to best practices and keeping themselves updated about security features.

8. Senisieta vs. Competitors: A Comparative Analysis

Feature Comparison

Seni sieta has a distinct combination of characteristics that make it stand out in a competitive marketplace. A thorough evaluation of Senisieta’s features highlights the benefits that have made it the go-to option for many.

User Feedback

The success of Senisieta is heavily dependent on listening to user comments. Updates and enhancements have been driven by positive user experiences and constructive feedback, guaranteeing that Seni sieta grows to meet user demands.

Pricing Structure

The straightforward and adaptable price structure of Seni sieta ensures that customers get good value for their money. Customers love the reasonable pricing that works for both solopreneurs and multinational corporations.

9. Future Developments and Updates for Senisieta

Upcoming Features

The dedication to innovation of Senisieta has not wavered. Look forward to future updates that will expand the tool’s functionality even more, ensuring it remains cutting edge in [Relevant Industry].

User-Requested Improvements

The development of Seni sieta is still influenced by user comments. The team takes customer feedback seriously and works to improve the service based on suggestions.

Collaborative Development

When it comes to growth, Senisieta promotes teamwork. By taking part in beta testing, users can help make sure that upcoming additions are up to snuff and meet user expectations.

10. Success Stories: Businesses Thriving with Senisieta

Real-Life Examples

Take a look at some actual companies that have used Seni sieta and seen how it has changed their lives. The tool’s adaptability and the good effects it has had on many sectors are demonstrated by these success stories.

Testimonials

The many positive impacts that Senisieta has had are highlighted in user testimonials. Testimonials from real users highlight the tool’s versatility and lend credibility to its reputation.

11. Senisieta: A Tool for Individuals and Businesses Alike

Scalability

Seni sieta can adapt to the demands of every business, no matter how big or little. Its adaptability makes it a worthwhile investment for companies and people of all sizes.

Versatility

Senisieta’s adaptability makes her a competitive candidate for a wide range of jobs and fields. Because of its flexibility, people from many walks of life may tap into its potential for greater productivity.

12. The Importance of Regular Updates and Maintenance

Security Updates

To make sure you have the most recent security patches, be alert and install updates often. Timely upgrades that protect user data demonstrate Senisieta’s dedication to security.

Performance Enhancements

Not only can routine maintenance fix problems before they happen, but it also improves performance. Seni sieta runs more smoothly and efficiently for those who keep up with the latest upgrades.

New Feature Rollouts

Frequently, upgrades bring about the introduction of new and exciting features. To make the most of Senisieta and anticipate market trends, monitor the release of new features.

13. Community Engagement and Support

User Forums

Participate in the active Seni sieta community through the user forums. To make the most of Seni sieta, talk to other users, get their recommendations, and join in on the conversation.

Customer Support Channels

Senisieta provides several avenues for customer help in the event that you face any difficulties. You may rest certain that any problems you have will be promptly resolved with responsive help.

14. How Senisieta Adapts to Industry Trends

Incorporating AI and Machine Learning

By using AI and ML skills, Seni sieta stays ahead of the curve in the business. By enhancing the tool’s capabilities, these technologies provide users with sophisticated features that enhance efficiency.

Staying Ahead of the Curve

Senisieta is a dependable option for professionals that appreciate innovation and flexibility because of their proactive development and dedication to staying ahead of market trends.

15. Conclusion: Senisieta as the Future of [Relevant Industry]

Finally, Senisieta has changed the game for experts in [Relevant Industry] thanks to its powerful and flexible features. Its versatility, powerful features, and intuitive interface put it ahead of the competition. Seni sieta is devoted to innovation and will continue to do so as long as technology is ever-changing.

16. FAQs

1. Is Senisieta suitable for small businesses?

Sure thing! Because of its adaptability, Seni sieta is perfect for companies of any size.

2. How often are updates released for Seni sieta?

Users are guaranteed to enjoy the most up-to-date features and security measures with Senisieta’s frequent upgrades.

3. Can Senisieta be accessed on mobile devices?

Seni sieta works with a wide range of devices, including tablets and smartphones.

4. What sets Seni sieta apart from other tools in the market?

The comprehensive capabilities, user-friendly design, and dedication to customer input that Seni sieta offers set it apart.

5. Is there a free trial available for Senisieta?

Use the free trial to get a feel for Seni sieta and see what all the fuss is about before you commit.

-

TECH8 months ago

TECH8 months agoExploring the Exciting Features of PHP Version 8.1 for Enhanced Web Development

-

CRYPTO4 months ago

CRYPTO4 months agoUnlocking the Potential: Understanding WalletConnect là gì

-

NEWS5 months ago

NEWS5 months agoBestadvise4u.com News: Your Gateway to Informed Living

-

ENTERTAINMENT5 months ago

ENTERTAINMENT5 months ago“кинокрадко” – Unmasking the Culprit Behind Film Piracy

-

TECH4 months ago

TECH4 months ago“몽세리 266b+v”: Revolutionizing Technology for a Better Future

-

HEALTH6 months ago

HEALTH6 months agoTough Tissue Muscle Connector: The Unsung Heroes of Movement

-

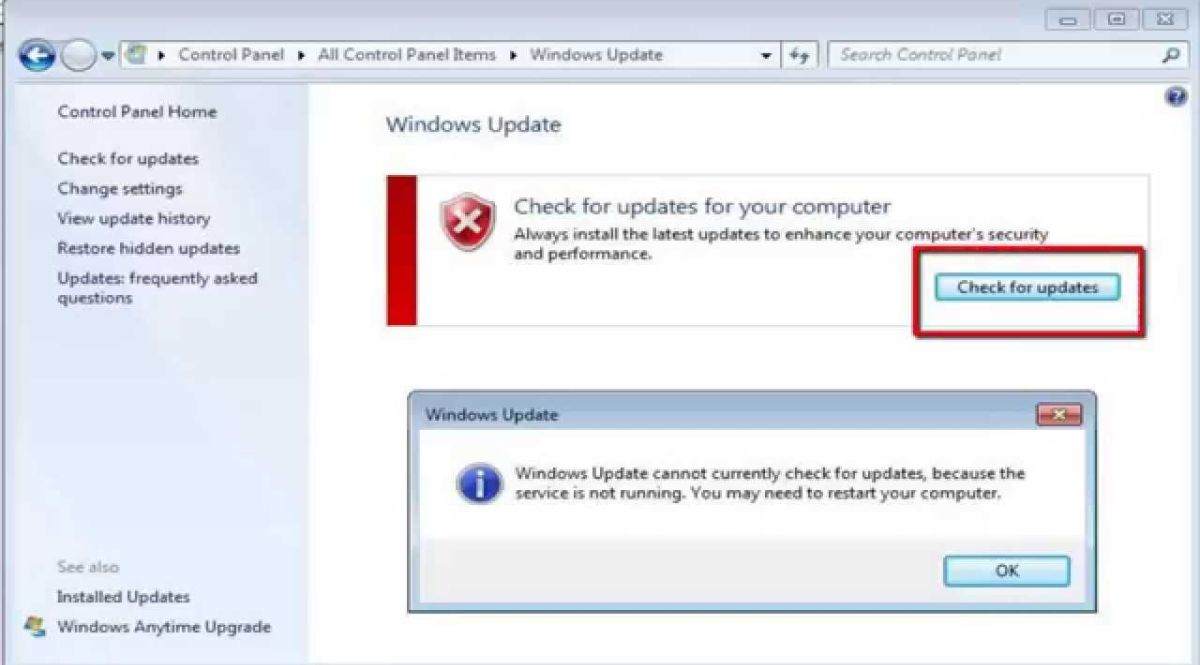

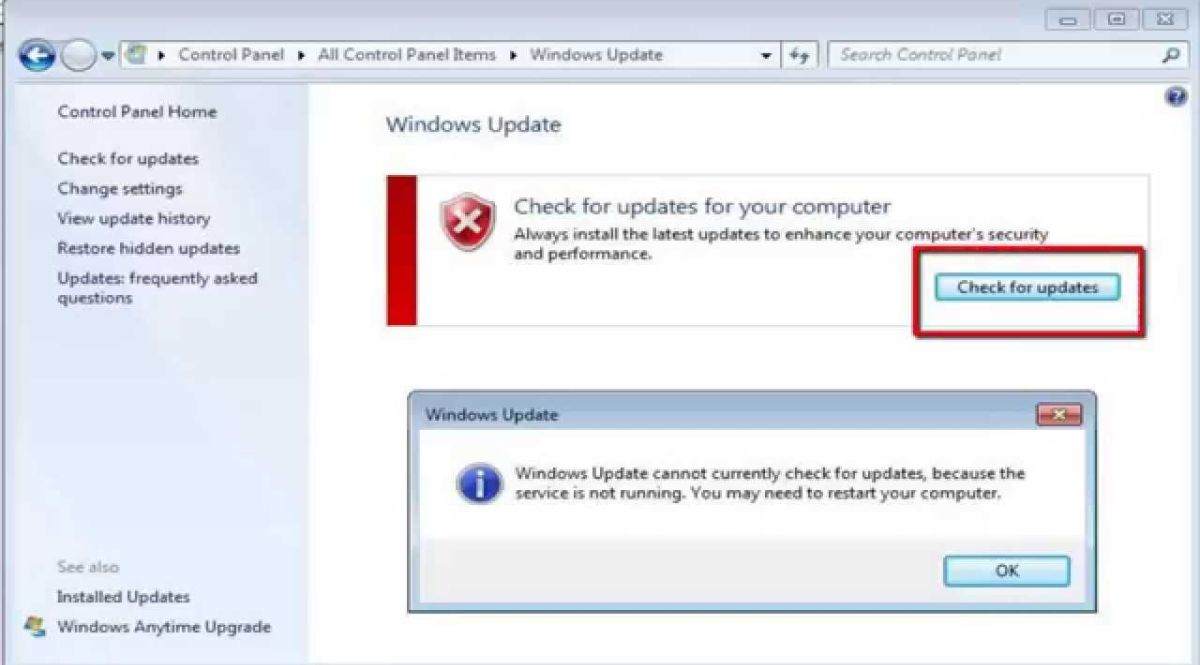

WINDOWS11 years ago

WINDOWS11 years ago(solved)-Windows update cannot currently check for updates, because the service is not running. You may need to restart your computer

-

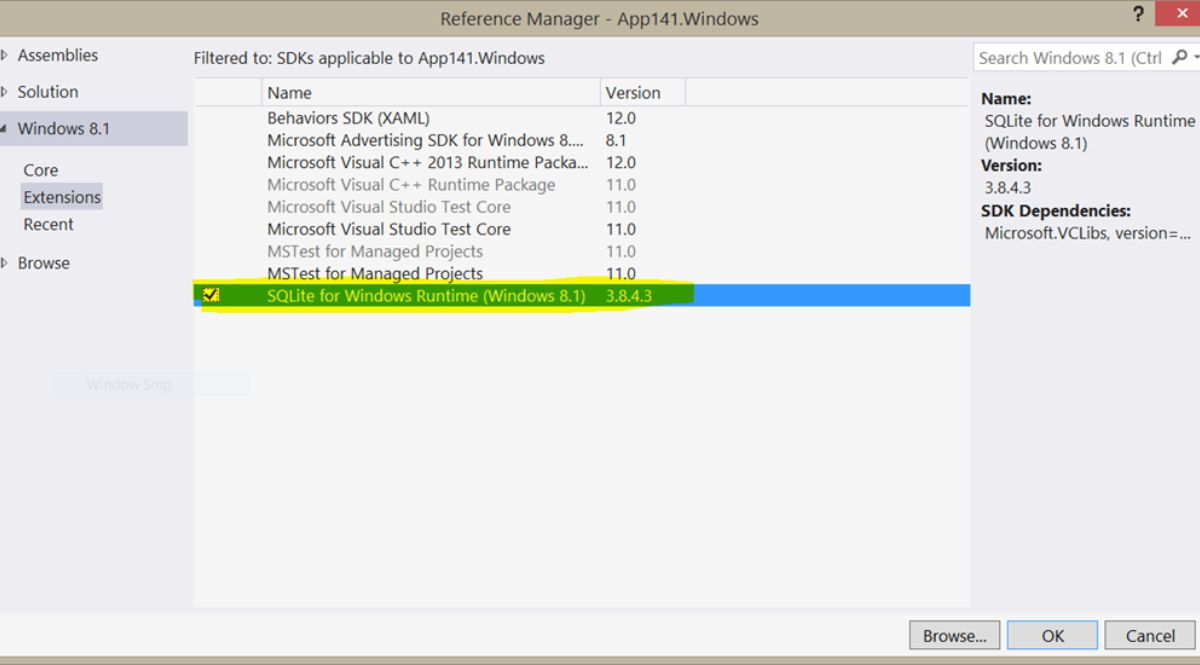

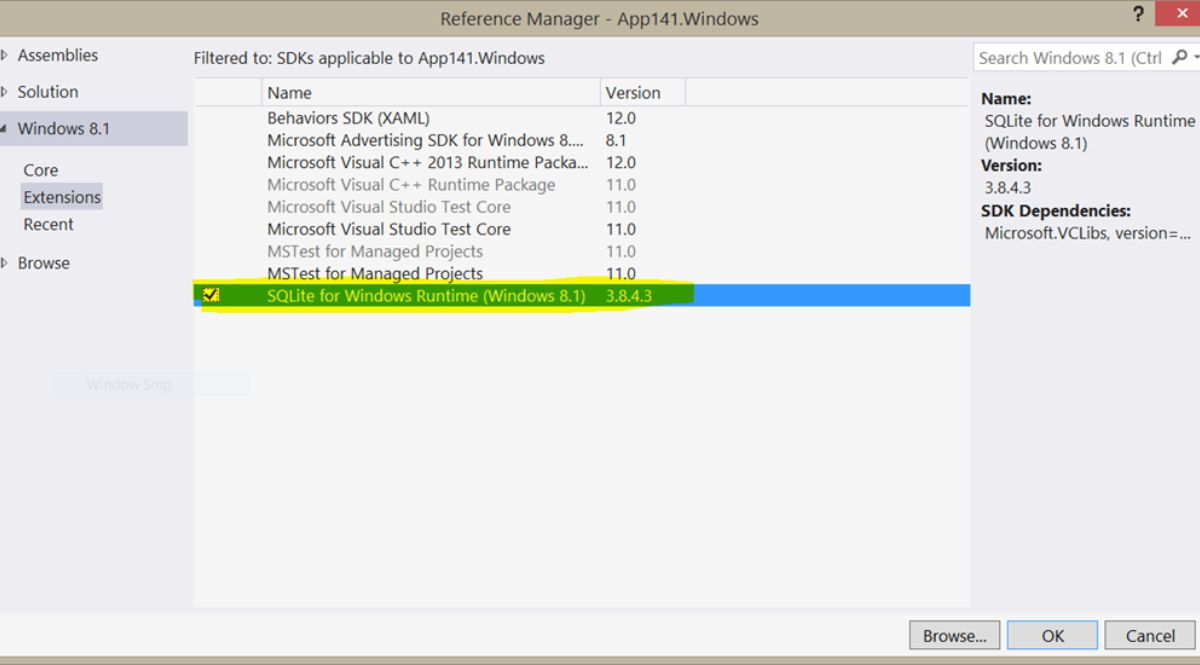

WINDOWS9 years ago

WINDOWS9 years ago(Solved) – “How do you want to open this type of file (.js)?” Windows 8/8.1