FINANCE

Snap Finance Auto Repair: An Affordable Solution for Vehicle Maintenance

Driving a vehicle is becoming increasingly recognized as a necessity in today’s hurried environment. Possessing a car at your command is practical, but additionally comes with the duty of preserving it in its optimal condition. Unplanned failures and the cost of necessary repairs can put a serious hole in your savings. Here’s where Snap Finance Auto Repair comes in to help people in need of low-cost repair options for their vehicles.

Understanding the Snap Finance Advantage

What is Snap Finance?

Snap Financing is a funding provider that offers services for an extensive spectrum of requirements, including maintaining your vehicle. They intend to offer assistance to those who might not have enough cash on hand to pay for costly maintenance to their vehicle straight away.

Snap Finance Auto Repair: How Does It Work?

Snap Finance partners with a vast system of garages all throughout the United States. Visit one of these service locations when you have car trouble and ask about Snap Finance’s financing possibilities. Easy application and quick processing time make this a viable option for many people.

The Benefits of Snap Finance Auto Repair

No Credit Check

Snap Finance’s refusal to do standard credit checks is one of the service’s primary selling points. That’s great news because it means those with less-than-perfect credit can still get the vehicle repair financing they need. Your capacity to repay payments is a primary factor in our acceptance decision.

Quick and Easy Application

Snap Finance simplifies the application procedure to make it as easy as possible for the customer. A decision is often made within minutes of applying, whether you do it online or in person at the partnering vehicle repair business.

Flexible Payment Options

Snap Finance provides personalized payment options to suit your budget. You have the flexibility to repay your loan on a weekly, biweekly, or monthly basis, depending on your financial situation.

Wide Network of Affiliated Repair Shops

Customers may easily identify a nearby vehicle repair shop that works with Snap Finance because of the company’s extensive network of repair facilities. With such extensive accessibility, you should never worry about being far from a reputable service center.

Competitive Interest Rates

Snap Finance’s interest rates are reasonable when compared to those of similar alternative lenders. You may feel assured that the interest rates and costs you incur will be reasonable.

When Should You Consider Snap Finance Auto Repair?

Unexpected Repairs

The unexpected can happen at any time in life, including the breakdown of your automobile. When an unexpected repair expenditure arises, Snap Finance may be a lifesaver in terms of getting you back on the road as soon as possible.

Planned Maintenance

Some car repairs might be more expensive than expected, even if you have a set maintenance program. Snap Finance can assist you with meeting these costs with minimal impact to your current financial situation.

Limited Savings

Snap Finance is a beneficial alternative if you don’t have an adequate account of savings for unforeseen expenditures. In that manner, you won’t have to fix anything that needs mending simply because you cannot afford to.

Conclusion

When you need quick and easy financing for car repairs, turn to Snap Finance Auto Repair. It has quickly become the go-to choice for people who want to keep their vehicles in top shape without breaking the bank because there are no credit checks, approvals are instant, and there is a large network of associated repair shops.

FAQ’s

- Is Snap Finance available nationwide?

- Customers from everywhere in the country may take advantage of Snap Finance because of their extensive network of associated service centers.

- Are there any hidden fees with Snap Finance?

- There are no surprises when it comes to costs with Snap Finance. During the application process, you will get a detailed description of all terms and conditions.

- How quickly can I get approved for Snap Finance?

- Snap Finance’s approval procedure is often quite quick, taking no more than a few minutes.

- Can I use Snap Finance for routine vehicle maintenance?

- You may utilize Snap Finance for both unanticipated and scheduled maintenance.

- Is Snap Finance a better option than traditional auto loans?

- Quick Finance allows consumers with a broad spectrum of credit , making it a great option to consider for individuals with a poor credit score who are still in need of a car loan. It ought to be considered to assess rates and terms before selecting the one that works best for business.

FINANCE

Unlocking the Potential of HDII Message Board

Online platforms have become the standard for interactions in today’s digital age, marking a huge shift in the way people communicate. The HDII Message Board is one such site that is rising in popularity. In this instance, we’re going to discuss what an HDII Communication Board is, the reason why it’s useful, and how it may transform the face of online discussion forums forever. So let’s go on the journey to learn more about this moment’s form of communication.

Understanding HDII Message Board

What is the HDII Message Board?

The HDII Message Board is a state-of-the-art communication system made to simplify collaboration amongst groups of people of all sizes. The platform facilitates communication, data sharing, and efficient teamwork among its users.

The Evolution of Messaging

Let’s get started, take a step back and evaluate how far information has come before we proceed. Communication has advanced a long way from the bygone era of pen and paper to the modern day age of email and IM. The HDII Message Board is the next logical development in this direction.

The Key Features of HDII Message Board

1. User-Friendly Interface

HDII Message Board’s user-friendly design caters to people of varying levels of computer literacy.

2. Threaded Conversations

Threaded conversations on the platform make it simple to track conversations and understand their progression.

3. Multimedia Support

Multimedia Support In addition to text, users may now upload and share movies, photos, and documents, greatly expanding the expressive potential of their interactions.

4. Real-time Notifications

With real-time alerts, you’ll never miss a message or change in status again.

Why HDII Message Board Matters

Enhancing Collaboration

HDII Message Board is an online bulletin board that allows team members to communicate and collaborate regardless of their location in today’s increasingly mobile workforce.

Community Building

A message board may increase a group’s or community’s feeling of community by serving as a central location for sharing news, information, and ideas.

Security and Privacy

HDII Message Board places a premium on data security and provides extensive privacy options to safeguard your interactions.

How to Get Started

1.Sign Up

To get started, create an account on the HDII Message Board. The whole thing can be done in a matter of minutes.

2.Create or Join a Board

Some of you have the option of either starting a fresh discussion board or signing up for an existing one. You can adjust the settings to suit your requirements and interests.

3.Start Conversations

Start threads by making posts or answering others’. The threaded design facilitates neat dialogue.

4.Explore Features

Make the most of the tools at your disposal, such as multimedia support and instant notifications.

The Future of Communication

The future of communication appears to be the HDII Message Board. Its adaptability, ease of use, and safety measures make it an indispensable medium for social and business contacts alike. Embrace the modern era of communication and see for yourself what a difference it makes.

Conclusion

The HDII Message Board is a potent ally in today’s interconnected society. Its usefulness in today’s digital world stems from the fact that it can bring people together, encourage teamwork, and guarantee safety. Why wait then? Improve your online interaction by being a part of the HDII Message Board community.

FAQ’s (Frequently Asked Questions)

- Is the HDII Message Board free to use?

- Yes, HDII Message Board has a free edition that includes the essentials, and paid upgrades for more advanced capabilities.

- Can I use the HDII Message Board for personal use?

- Absolutely! You may utilize the HDII Message Board for everything from one-on-one conversations to community discussions.

- How secure is the HDII Message Board?

- HDII Message Board takes the safety of its users’ information very seriously and uses encryption and other privacy safeguards to do so.

- Can I use the HDII Message Board on mobile devices?

- The HDII Message Board is available for use on both desktop computers and mobile devices.

- Are there any limits on the number of users on a board?

- The number of users on a board is capped in the free edition, while premium subscriptions allow for expansion to accommodate bigger groups or organizations.

FINANCE

Personal Loans FintechZoom: Revolutionizing the Borrowing Experience

Many individuals, particularly in the modern world, want easy and rapid financial choices. Personal loans have grown to be a vital resource for those in need of monetary assistance for a wide range of explanations, including funding for emergency medical care, funding for college, and maintaining basic living costs. Personal Loans FintechZoom is merely a single instance of the manner in which fintech firms have thrown off the lending sector and made it easier for borrowers to secure and repay their loans. In the following article, we’ll delve into the captivating realm of personal loans utilizing FintechZoom, highlighting how this leading-edge platform is revolutionizing the method in which people borrow cash.

Table of Contents

- Introduction

- The Rise of Fintech in Lending

- What Sets Personal Loans FintechZoom Apart

- Applying for a Personal Loan on FintechZoom

- Fast Approval and Disbursement

- Flexible Repayment Options

- Transparency and Accessibility

- Personal Loans vs. Traditional Banking

- Security Measures

- Interest Rates and Fees

- Credit Score and Eligibility

- Customer Support

- Building Financial Literacy

- Conclusion

- Frequently Asked Questions (FAQs)

Introduction

For the purpose of consolidating debt or paying towards a once-in-a-lifetime vacation, personal loans have been for years a crucial tool for many people. However, the traditional approach of obtaining funding requires a lot of red tape, a lengthy wait, and strict requirements. For the same reason, financial technology businesses like FintechZoom have made the process of getting a loan a lot easier.

The Rise of Fintech in Lending

Borrowing is only one industry that has been negatively impacted by the rise of financial technology startups. Organizations in the finance technology sector use modern technology that streamlines the loan process, providing borrowers speedier access to money.

What Sets Personal Loans FintechZoom Apart

Cash Advances FintechZoom’s dedication to client happiness, fast service, and straightforward design make it stand out in the competitive loan market. The safety and comfort of the borrower are top priorities on this platform.

Applying for a Personal Loan on FintechZoom

Personal loan applications on FintechZoom have an easy application process. An application for a loan may be performed online when a user establishes an account and fills out the fields that are needed. Users with no prior technological innovations experience are going to have no trouble going around the site as a result of its straightforward design.

Fast Approval and Disbursement

Personal Loans Fintech Zooms lightning-fast approval and funding times are a major selling point. FintechZoom may quickly approve loans (often within minutes) and release the money, in contrast to the weeks it can take for a typical bank to complete a loan application.

Flexible Repayment Options

FintechZoom recognizes that there is no universally applicable approach to loan repayment. thereby, debtors can select the payment program that works most efficiently for them. As a result of this leeway, consumers don’t have to feel imprisoned by the monthly payments on their loans.

Transparency and Accessibility

Cash Advances Authenticity is a cornerstone of FintechZoom’s culture. Before making a final decision, borrowers may quickly and simply check all relevant loan details, including interest rates and fees. This amount of openness is beneficial because it allows debtors to make educated choices regarding their money.

Personal Loans vs. Traditional Banking

When comparing personal loans from FintechZoom to those from a bank, it’s clear that fintech provides a more convenient, efficient, and customer-focused service. While there are certainly benefits to banking, fintech meets the needs of the digital era by providing speed and ease.

Security Measures

It’s only normal to worry about your personal and financial data being safe while shopping or banking online. Borrowers may rest assured that their information will be kept private since FintechZoom uses industry-standard encryption and security measures.

Interest Rates and Fees

Fees and Interest FintechZoom aims to offer reasonable rates of interest and clear pricing. Personal loans are an accessible financial option for people in need of fast cash because of the fair and acceptable conditions to which borrowers may look forward.

Credit Score and Eligibility

When determining eligibility, traditional banks tend to place a premium on credit ratings, whereas FintechZoom considers a wider range of factors. The platform makes it possible for people with varied credit ratings to get personal loans.

Customer Support

If you have any queries or problems, you may contact FintechZoom’s helpful customer support team. At every point throughout the application and repayment of a loan, borrowers have access to comprehensive support services.

Building Financial Literacy

In addition to serving as a loan platform, FintechZoom is committed to helping its customers improve their financial literacy. Borrowers may increase their understanding of personal finance and learn to make responsible decisions with the help of available tools and advice.

Conclusion

Cash Advances FintechZoom has arisen as a ray of light for those in dire need of financial support. It has simplified the borrowing process with its straightforward layout, speedy approval, and dedication to openness. With the rise of fintech, obtaining a personal loan is quicker and more hassle-free than ever before.

Frequently Asked Questions (FAQs)

- Is Personal Loans FintechZoom safe to use?

- FintechZoom takes the safety of its users seriously and uses strong encryption to keep your information safe.

- What sets FintechZoom apart from traditional banks?

- When compared to traditional banking, the financing process with FintechZoom is far quicker, easier to access, and customer-focused.

- Are interest rates competitive on FintechZoom?

- Whether it comes to interest charges and fees, FintechZoom attempts to be as clear as practicable.

- Do I need a high credit score to qualify for a loan on FintechZoom?

- At FintechZoom, we look at far more than just your score on the credit report whenever determining whether you’re qualified for a loan.

- How can I reach customer support at FintechZoom?

- The kind employees at FintechZoom may be reached easily and rapidly through the website’s contact form.

FINANCE

Coffee Break Loans Reviews: Your Ultimate Guide to Quick Cash

In the fast-paced world of today, individuals might unexpectedly discover themselves in need of financial aid due to unanticipated expenditures. An increasing amount of people choose to turn to Coffee Break Loans as soon as they need immediate funding with minimal red tape. With the aforementioned thorough examination, we will delve into the fascinating world of coffee. Coffee Break Loans Reviews, containing information about the business itself, its services, and any relevant pros and downsides.

Understanding Coffee Break Loans

Coffee Break Loans Reviews is a web-based organization that facilitates communication between potential borrowers and a group of reliable loan providers. This online loan marketplace has become popular due to its convenient and rapid approval procedures. Let’s have a deeper look at what makes Coffee Break Loans so special.

Speedy Loan Approval Process

Coffee Break Loans stands apart from the competition because of its incredibly quick loan approval time. There’s no time to waste waiting around for loan approval at times of extreme financial need. Coffee Break Loans offers a convenient online application that, in many situations, may result in instant approval. For people in dire straits with their finances, this is a godsend.

Accessibility for All Credit Types

Coffee Break Loans Reviews works with borrowers with varying FICO ratings. Coffee Break Loans accepts loan applications from people with a wide range of credit histories and scores. The lenders in their network take into account more than simply credit scores when providing loans, therefore many more applicants are approved.

Flexible Loan Options

Financing alternatives from Coffee Break Loans are numerous. Personal loans, installment loans, and short-term loans are all readily accessible to borrowers. As a result of this, you may modify the terms and conditions of your loan to fit with your finances and requirements.

Minimal Documentation

The days of being buried under a pile of paperwork when applying for a loan are over. Coffee Break Loans simplifies the procedure by requesting only basic paperwork from applicants. Applying online eliminates the need to travel to a branch and may be done in a fraction of the time it takes to fill out a paper application.

Transparent Terms and Conditions

Loans During Coffee Break Reviews is proud of its policy of complete openness. Borrowers are provided with easy-to-understand terms and conditions so that they may make an informed decision before taking a loan. For prudent borrowing, this openness is essential.

Pros of Coffee Break Loans

Now that we’ve covered the fundamentals of Coffee Break Loans, let’s go into the benefits it provides.

- Quick Funding: The fast approval procedure means you may access the money you need quickly, which is very helpful in unexpected financial situations.

- Wide Acceptance: Coffee Break Loans has a large pool of lenders that will deal with clients of varying credit histories because of the network’s flexible underwriting standards.

- Variety of Loan Options: The platform provides a wide selection of loan options from which borrowers may select the product that best meets their requirements.

- Minimal Documentation: The online application procedure requires nothing in the way of documentation, which is a major perk.

- Transparency: Coffee Break Loans are up forward about all the fees and interest rates that will accrue on your loan.

Cons of Coffee Break Loans

There are benefits to using Coffee Break Loans, but there are also some negatives to think about.

- Interest Rates: Coffee Break Loans, like many short-term lenders, may charge more in interest than a regular bank would. The borrower should budget for these expenses.

- Risk of Debt Cycle: There is the potential for a never-ending cycle of debt to trap debtors who don’t practice responsible money management.

- Not a Solution for Long-Term Financial Problems: Coffee break loans are intended for temporary cash flow needs and should not be considered as a long-term financial solution. It’s possible they won’t work to fix your money woes permanently.

Conclusion

When you need cash quickly, Coffee Break Loans Reviews is a reliable online loan outlet to turn to. As a result of its quick approval time, availability to borrowers with varying credit histories, and adaptability of loan terms, it is a popular alternative among borrowers. It’s important to take caution while utilizing such services because of the higher interest rates linked with short-term loans.

You should carefully consider your financial status, the loan’s terms and circumstances, and whether or not borrowing is the best answer to your needs before applying for a loan through Coffee Break Loans Reviews or any other lending site. Coffee Break Loans Reviews, when utilized properly, may give the financial aid necessary to conquer unforeseen difficulties.

FAQ’s

- How do I apply for a loan with Coffee Break Loans?

- The process of applying for a loan with Coffee Break Loans is easy. To get things started, just visit their website and subscribe there. In order for this to happen, we need particular data from you, including some financial and personal details. Following submitting your application, you’ll be addressed by lenders in their network who may be interested in providing the opportunity for a loan.

- What are the eligibility criteria for a Coffee Break Loans loan?

- A U.S. citizen or legal resident, age 18 or older, with a consistent source of income and a checking or savings account are often required qualifying conditions, however these may vary by lender.

- How quickly can I expect to receive the funds once approved?

- This varies from lender to loan. Many borrowers, however, say they get their money the next working day following approval. One day funding is possible with some lenders.

- Are there any fees associated with applying for a loan through Coffee Break Loans?

- To facilitate your search for a loan, Coffee Break Loans does not charge any fees. Loan origination fees and other loan-related costs may be charged by the lender; thus, it is important to thoroughly understand the terms and conditions of any loan offer.

- Can I repay my loan early without penalties?

- Prepayment choices may also differ by lender. Borrowers can save money on interest by paying off their loans early with some lenders that do not charge prepayment penalties. Be sure to verify the specifics with your lender.

-

TECH8 months ago

TECH8 months agoExploring the Exciting Features of PHP Version 8.1 for Enhanced Web Development

-

CRYPTO4 months ago

CRYPTO4 months agoUnlocking the Potential: Understanding WalletConnect là gì

-

NEWS5 months ago

NEWS5 months agoBestadvise4u.com News: Your Gateway to Informed Living

-

ENTERTAINMENT5 months ago

ENTERTAINMENT5 months ago“кинокрадко” – Unmasking the Culprit Behind Film Piracy

-

TECH4 months ago

TECH4 months ago“몽세리 266b+v”: Revolutionizing Technology for a Better Future

-

HEALTH6 months ago

HEALTH6 months agoTough Tissue Muscle Connector: The Unsung Heroes of Movement

-

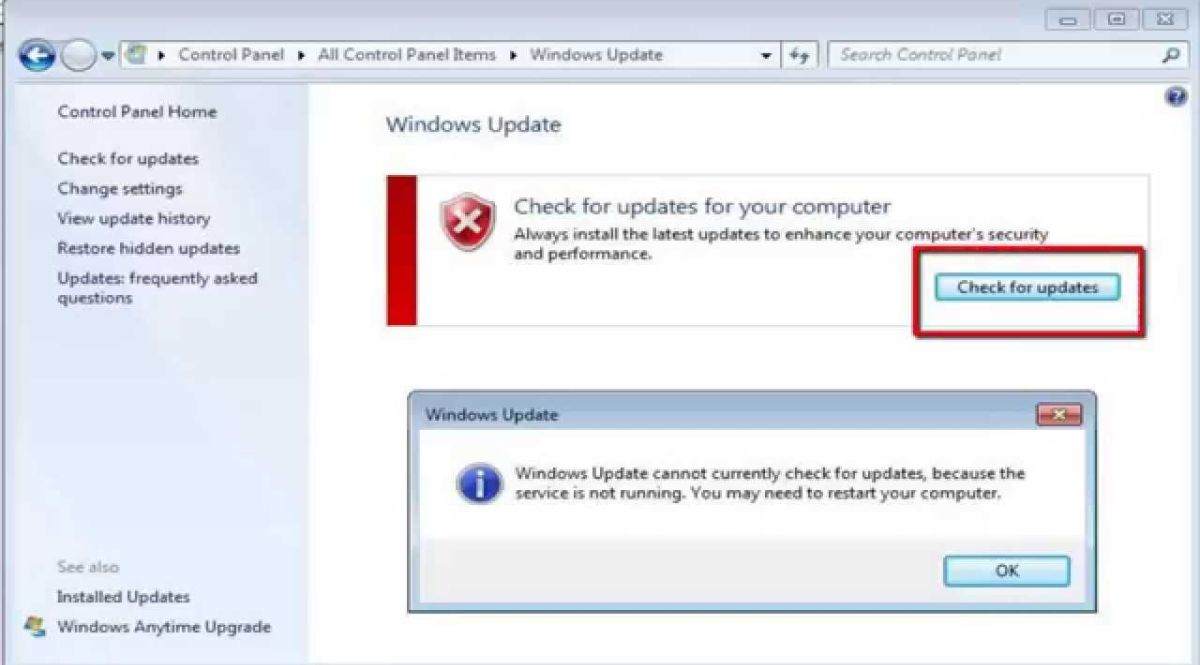

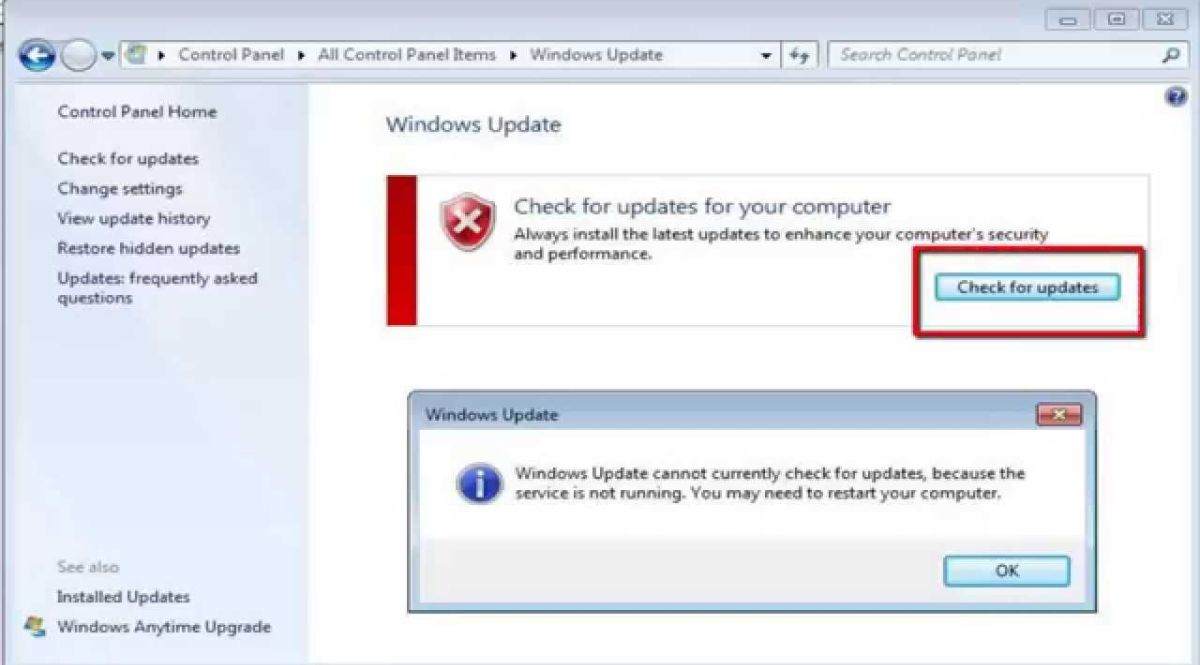

WINDOWS11 years ago

WINDOWS11 years ago(solved)-Windows update cannot currently check for updates, because the service is not running. You may need to restart your computer

-

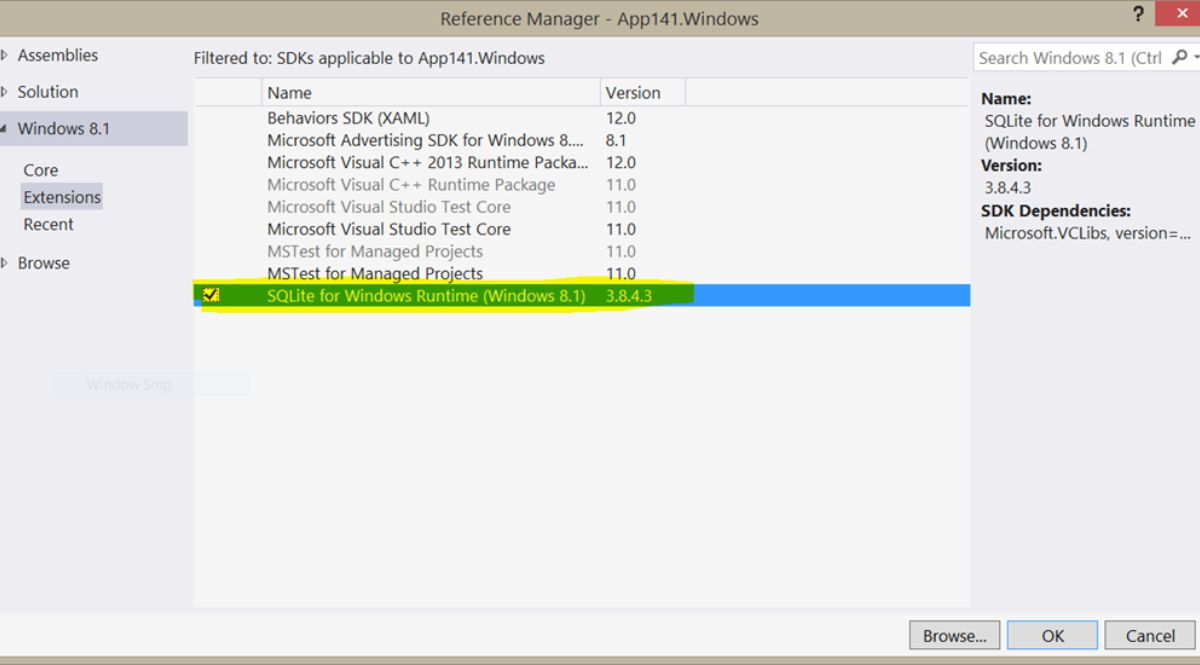

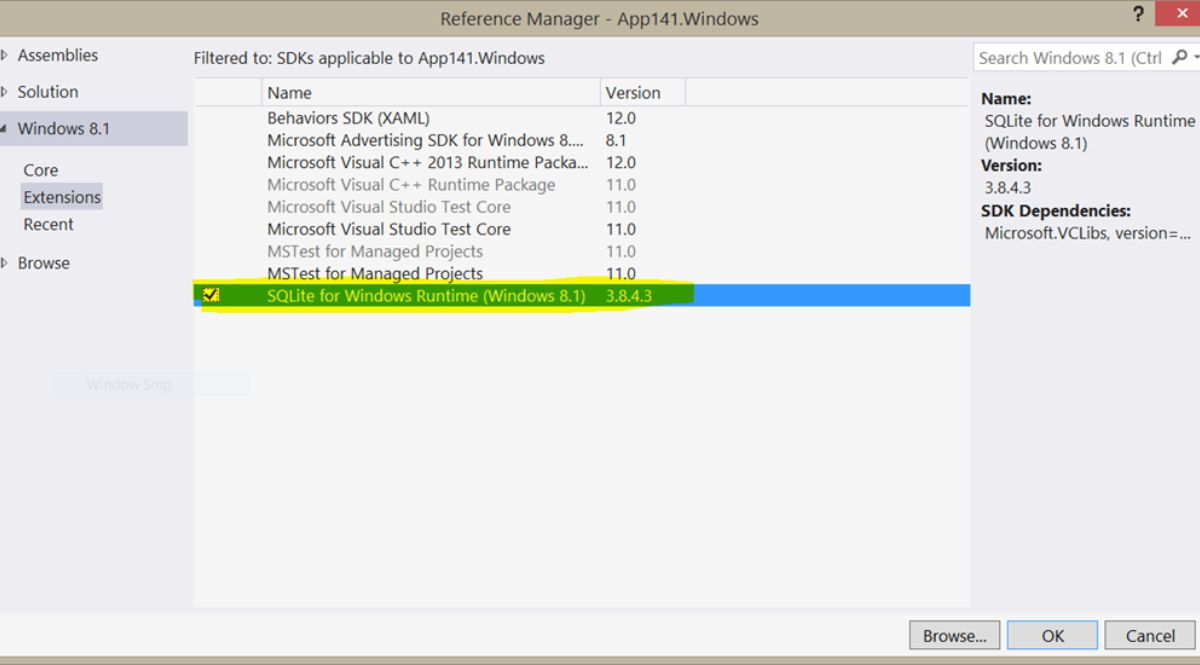

WINDOWS9 years ago

WINDOWS9 years ago(Solved) – “How do you want to open this type of file (.js)?” Windows 8/8.1