INSURANCE

Understanding the Transformative Impact of FintechZoom Life Insurance

FintechZoom Life Insurance is an important development in today’s unpredictable financial system. Not only does this unusual approach to life insurance deliver policyholders with financial stability, but it also drastically changes our understanding of and relationships with the life insurance sector as entirety. In this detailed investigation, we’ll examine FintechZoom Life Insurance from all perspectives, including its features, benefits that are and profound implications on the insurance system.

Table of Contents

- Introduction: The Fintech Revolution

- What is FintechZoom Life Insurance?

- The Key Advantages of FintechZoom Life Insurance

- How FintechZoom is Changing the Insurance Landscape

- The Role of Technology in FintechZoom Life Insurance

- FintechZoom Life Insurance vs. Traditional Insurance

- The Ease of Access and Convenience

- Personalization and Tailored Coverage

- Cost-Efficiency and Transparent Pricing

- Enhanced Customer Experience

- Security and Privacy Concerns

- Regulatory Challenges and Compliance

- The Future of FintechZoom Life Insurance

- Real-Life Success Stories

- Conclusion: Embracing the Fintech Revolution in Insurance

Introduction: The Fintech Revolution

Thanks to finance technology companies like FintechZoom, the financial services sector is undergoing a sea transformation. Traditional guidelines have been questioned and many industries are being reshaped as the consequence of these challengers. In particular, FintechZoom Life Insurance represents this shift.

What is FintechZoom Life Insurance?

FintechZoom Life Insurance is a cutting-edge strategy that streamlines the life insurance procedure with the use of cutting-edge technology. Innovative digital technologies are seamlessly integrated with time-tested life insurance concepts to provide superior service to policyholders.

The Key Advantages of FintechZoom Life Insurance

Streamlined Application Process: FintechZoom has simplified the insurance application process by doing away with the paperwork normally required for such policies. Customers can apply for policies online with low paperwork requirements.

Quick Underwriting: Without the assistance of AI and data analytics, underwriting are able to make quicker choices, decreasing the time they require for them to grant insurance coverage.

Flexible Coverage:FintechZoom’s principles are flexible so businesses may select the selections that most accurately reflect their specific requirements.

Affordability: FintechZoom offers reasonably priced insurance alternatives since it cuts out the middleman and other unnecessary overhead expenses.

How FintechZoom is Changing the Insurance Landscape

The innovative business strategy of FintechZoom has caused conventional insurers to rethink their strategies. To maintain relevance, businesses have come to realize they must adopt digital strategy.

The Role of Technology in FintechZoom Life Insurance

FintechZoom Life Insurance is completely tech-driven. Technology promotes effectiveness, safety, and openness in areas such as underwriting (thanks to AI) and security (thanks to blockchain).

FintechZoom Life Insurance vs. Traditional Insurance

When compared to traditional insurance, FintechZoom Life Insurance has significant advantages in terms of convenience, cost, and satisfaction of policyholders.

The Ease of Access and Convenience

FintechZoom Life Insurance’s ease of use stands out among its other notable qualities. Using simple mobile applications, policyholders can apply for, manage, and file claims on their policies from the convenience of their own homes.

Personalization and Tailored Coverage

Individuals may tailor their coverage with FintechZoom, paying for just the services they really use. Such individualized coverage is unusual in the insurance industry.

Cost-Efficiency and Transparent Pricing

The cost and coverage details of conventional insurance policies are notoriously opaque. By providing policyholders with up-front price information, FintechZoom streamlines this process.

Enhanced Customer Experience

The insurance business as a whole now needs to compete with FintechZoom, which has set a new standard for user experience. A superior customer service experience is the result of prompt replies, user-friendly interfaces, and round-the-clock help.

Security and Privacy Concerns

Concerns regarding data privacy and cybersecurity continue to be a problem, despite FintechZoom’s best efforts. The business world must take the initiative to solve these problems.

Regulatory Challenges and Compliance

FintechZoom Life Insurance is a dynamic industry that presents issues for authorities. Constant effort is put into finding middle ground between progress and consumer safety.

The Future of FintechZoom Life Insurance

FintechZoom Life Insurance appears to be on a path of rapid expansion and ground-breaking new features. Traditional insurers must make the transition to digital solutions as more customers choose for them.

Real-Life Success Stories

The experiences of those who have benefitted from FintechZoom Life Insurance can shed light on the policy’s efficacy and its influence on policyholders’ lives.

Conclusion: Embracing the Fintech Revolution in Insurance

More than just a life insurance policy, FintechZoom represents the new wave of financial technology. A major turning point in the development of the insurance sector has been reached because of its capacity to streamline, individualize, and improve services. Policyholders may rest easy knowing that their future is more secure and bright if they accept this adjustment.

FAQ’s

- Is FintechZoom Life Insurance available worldwide?

- Customers can be located anywhere in the world since FintechZoom Life Insurance is available to everybody.

- What types of policies does FintechZoom offer?

- Term life, whole life, and universal life insurance are just some of the options you’ll find at FintechZoom.

- How does FintechZoom ensure the security of customer data?

- The data of FintechZoom’s customers is protected by cutting-edge encryption and other cybersecurity safeguards.

- Can I switch from my current insurance to FintechZoom Life Insurance?

- To answer your question directly: depending on the conditions of your current insurance, you can switch to FintechZoom Life Insurance at any moment.

- What sets FintechZoom apart from other digital insurers?

- FintechZoom stands out from the crowd of digital insurance providers thanks to its dedication to individualization, affordability, and superior customer service.

INSURANCE

OpenHousePerth.net Insurance: Safeguarding Your Home with Confidence

The positive aspects and burdens of homeownership do not seem indistinguishable. Insurance ought to become a homeowner’s foremost concern. Learn more about OpenHousePerth.net insurance in this comprehensive in-depth guide, including the many types of coverage, their advantages, and why it’s worthwhile to get it for the things you own.

Understanding OpenHousePerth.net Insurance

OpenHousePerth.net offers a variety of plans to suit the various requirements of different homeowners. They safeguard your investment against unanticipated events with plans ranging from fundamental protection to comprehensive. You may rely on OpenHousePerth.net in times of need, irrespective of natural catastrophes, theft, or virtually anything whatsoever.

Why OpenHousePerth.net Insurance is a Smart Choice

The affordable prices offered by OpenHousePerth.net insurance are one of the site’s most notable benefits. They have received positive feedback from happy clients because of their inexpensive premiums that do not sacrifice coverage. Customer reviews of OpenHousePerth.net insurance have raved about how dependable and affordable it is.

How to Get a Quote

OpenHousePerth.net makes getting a quotation a snap. In a matter of minutes after entering their information, homeowners may get a personalized price using their intuitive web platform. You may obtain exactly what you need without paying for extras thanks to the ability to customize coverage according to your needs.

Key Features of OpenHousePerth.net Insurance Policies

The insurance policies offered by OpenHousePerth.net are notable for the many coverage choices they provide. There are several different designs to choose from, so you can obtain exactly what you please need, whether it’s coverage for the framework of your house or your personal belongings. One way that their insurance policies may be tailored to what you require is by allowing you to add supplementary insurance policies.

Tips for Choosing the Right Coverage

Identifying One’s Own Requirements Is the First Step in Choosing Appropriate Insurance Coverage. Take stock of what you have, assess your risks, and contact insurance professionals—that’s what OpenHousePerth.net suggests to homeowners. In this way, homebuyers can be certain that their assets are purchasing coverage that is personalized for their particular situation.

Claims Process Simplified

Policyholders may rest easy knowing that OpenHousePerth.net has their backs in the case of a claim. In trying circumstances, you may rest easy knowing that they will handle your claims quickly and efficiently and that they have included a detailed guide to make the process easy to follow.

OpenHousePerth.net Insurance and Home Security

Beyond the scope of conventional insurance, OpenHousePerth.net encourages homeowners to fortify their homes with security systems. They give savings and other perks for better home safety by partnering with top security companies. Insurance and proactive risk prevention are brought together in this novel way.

Customer Support and Assistance

OpenHousePerth.net places a premium on customer service. Homeowners may get their questions answered quickly and easily by calling a responsive hotline that is open at all times. In the end, policyholders at OpenHousePerth.net benefit from this dedication to customer service.

Community Involvement and Social Responsibility

Beyond only securing people’s houses, OpenHousePerth.net shows its dedication to the community through its social responsibility initiatives and other forms of community involvement. They demonstrate a feeling of duty outside the insurance industry through their numerous programs and activities that help social concerns.

Comparing OpenHousePerth.net with Other Insurance Providers

With its distinctive features, OpenHousePerth.net distinguishes out in a crowded marketplace. They set themselves apart from other providers by offering affordable prices, extensive coverage, and unique collaborations. Choosing OpenHousePerth.net for your insurance requirements is advantageous, as shown by a comparison analysis.

Common Myths About Home Insurance

Homeowners don’t always make educated judgments because they believe in common myths regarding house insurance. Coverage, pricing, and the overall advantages of investing in a strong insurance plan are clarified by OpenHousePerth.net, which dispels popular fallacies.

OpenHousePerth.net Insurance for Renters

Although OpenHousePerth.net mostly targets homeowners, it also serves the needs of tenants. Customized insurance plans meet the unique requirements of renters, safeguarding their belongings and providing them with essential liability protection.

The Future of Home Insurance with OpenHousePerth.net

When it comes to house plans, OpenHousePerth.net is always one step ahead of the curve, even when technology changes. Continued provision of state-of-the-art solutions for homes is assured by their ability to adapt to evolving demands and embrace developments.

Conclusion

All things considered, OpenHousePerth.net insurance proves to be a dependable ally in protecting your property. They are unique in the insurance market because of their low prices, extensive coverage, and dedication to happy customers. Discover the many options available, personalize your coverage, and rest easy with OpenHousePerth.net insurance.

FAQs

How can I get a quote from OpenHousePerth.net?

Just visit their website and utilize the online quote form to easily get an estimate.

What types of coverage does OpenHousePerth.net offer?

Property, contents, and liability plans are just some of the choices available at OpenHousePerth.net.

Are there discounts available for home security measures?

Discounts and incentives are available to homeowners who invest in security measures through OpenHousePerth.net.

How fast is the claims process with OpenHousePerth.net?

To make things easy for policyholders, we made sure the claims procwass is quick and easy.

Does OpenHousePerth.net offer insurance for renters?

Yes, OpenHousePerth.net does provide personalized coverage plans to meet the needs of renters.

INSURANCE

Ztec100.com Tech Health and Insurance

There are new possibilities and difficulties that have arisen as a result of the convergence of technology, healthcare, and insurance in today’s world. This article dives into “ztec100.com tech health and insurance,” illuminating the interplay between healthcare and technology as well as Ztec100.com’s part in making health coverage more widely available.

1.The Intersection of Technology and Healthcare

The healthcare industry has been revolutionized by technological progress. Technological innovation, such as telecommunications- wearable health equipment, and based on information diagnostics, have streamlined healthcare delivery and shifted the spotlight back to the patient. With the implementation of technology, we were able to close the gap in healthcare availability between metropolitan areas and communities in the countryside.

2.The Role of Ztec100.com in Health Tech

Ztec100.com has become an industry leader because of the cutting-edge health management tools it provides. Services like remote doctor visits, pill reminders, and individual health records are all part of what it offers. Ztec100.com helps people take charge of their health and wellness by utilizing cutting-edge technologies.

3.Navigating the Insurance Landscape

Protecting oneself and one’s family from the financial burden of unforeseen medical bills is why health insurance exists. It might be difficult to find your way through the maze of insurance options. This is where advances in IT come in, streamlining procedures to make insurance easier to get and comprehend.

4.The Significance of Health Insurance

Possessing health insurance delivers peace of conscience in the event of an unanticipated medical expense. It decreases stress about medical expenses by paying for everything like hospitalisations, doctor visits, medications on prescription, and more. Consumers run the danger of having to make payments for expensive medical treatment out of pocket if they don’t have appropriate health insurance.

5.How Ztec100.com Enhances Insurance Accessibility

Ztec100.com connects the healthcare and insurance sectors by providing a straightforward resource for locating and comparing health coverage options. Users get easy access to a variety of resources, allowing them to make well-informed decisions regarding their health insurance with only a few clicks.

6.The Advantages of Ztec100.com

- Simplified Health Management: Ztec100.com provides helpful materials for preventive health management, simplifying the process for its users.

- Insurance Transparency: The website promotes insurance transparency by giving customers access to comprehensible details regarding available insurance policies.

- Cost Savings: Users may choose affordable insurance plans that work with their budgets, cutting costs over time.

7.Challenges in the Health and Insurance Tech Industry

Although the integration of technology into the medical and insurance industries has proved revolutionary, it has not been beyond its share of difficulties. Equal access to health care and insurance services, as well as concerns about data security and regulatory compliance, must be resolved enabling the system as a whole to function seamlessly and efficiently.

8.Innovations and Future Prospects

There is constant development in the healthcare and insurance technology sectors. There is hope in developments like the blockchain for storing private medical information and AI-powered claims processing. Ztec100.com is dedicated to remaining on the cutting edge of these developments so that its consumers may take full advantage of them.

9.Conclusion

Ztec100.com is a model of how the application of technology may improve the provision of medical care and insurance. People are able to take charge of their health and their insurance by using the system’s accessible tools and services. Ztec100.com and similar platforms will become increasingly important as the health and insurance IT business develops in the future.

10.FAQ’s

1.How can Ztec100.com help me manage my health?

You can take charge of your health with the help of Ztec100.com’s health monitoring, telehealth consultation scheduling, and medication reminder features.

2.Is it easy to find and compare health insurance plans on Ztec100.com?

Absolutely. Ztec100.com provides a simple interface for researching and comparing different medical coverage options.

3.What are the benefits of health insurance in the modern world?

Having insurance for your health protects you fiscally in case of an unexpected medical expense, making it easier on your financial plan.

4.What challenges does the health and insurance tech industry face today?

Data security, regulatory compliance, and guaranteeing equal access to healthcare and insurance services are just a few of the challenges faced by the business.

5.What can we expect from the future of health and insurance tech?

A more efficient and secure system is in sight, with developments like blockchain for secure health information and AI-driven claims processing.

INSURANCE

IASA Job Bank: Your Gateway to a Successful Career in Insurance

Finding a job in the insurance industry that fits your talents and career goals might be difficult because of the industry’s rapid pace of change. The IASA Job Bank steps in at this juncture, providing a ray of sunshine for those seeking rewarding opportunities in the insurance sector.

1.Understanding the Importance of IASA in the Insurance Industry

The International Association of Insurance Professionals (IASA) is a well-respected group that significantly influences the worldwide insurance industry. Insurers looking for work might benefit greatly from IASA because of the organization’s dedication to promoting career advancement and networking.

2.Navigating the IASA Job Bank Interface

The IASA Job Bank’s onboarding process is simple as pie. We’ll show you around the straightforward interface, making finding a job a snap.

3.Job Categories and Opportunities

Look at the many options in underwriting, claims, risk management, and actuarial science in the IASA Job Bank. Learn about all the different paths open to you.

4.How to Create an Effective IASA Job Bank Profile

You might think of your profile as an online CV. Find out what goes into an IASA Job Bank profile that gets seen by recruiters.

5.Crafting an Eye-catching Resume

Your resume serves as the initial introduction to potential employers. Helping you craft a resume that gets noticed is our specialty.

6.Cover Letters That Stand Out

The success of your application may hinge on how well you write your cover letter. Learn the art of crafting a cover letter that highlights your unique qualifications and experiences.

7.Preparing for Interviews

The ability to conduct interviews effectively is essential. Learn how to make a great impression during job interviews.

8.Networking in the IASA Community

Networking’s importance can’t be stressed enough. Find out how to make use of the resources provided by the IASA membership.

9.Success Stories: Realizing Your Dreams with IASA Job Bank

Learn from the experiences of those whose careers were launched with the help of the IASA Job Bank.

10.The Evolving Landscape of Insurance Careers

The insurance business is a growing one. The insurance industry is rapidly evolving, so it’s important to keep up.

11.Staying Informed with IASA’s Resources

IASA provides a plethora of insurance industry information for its members. Check out the resources at your disposal.

12.Balancing Professional Development and Personal Life

Integrating work and personal life is critical. We talk about methods for balancing work and personal commitments.

13.Navigating Challenges in the Insurance Industry

The insurance business has its own set of special difficulties. Figure out how to deal with adversity with poise and fortitude.

14.Conclusion: The Key to a Bright Insurance Career

In summary, the IASA Job Bank is the key to a rewarding and rewarding profession in the insurance sector. It connects you with the support system and information you need in order to accomplish outstanding accomplishments.

15.FAQ’s

1.What is the IASA Job Bank?

The IASA Job Bank is a digital resource that introduces insurance sector professionals seeking new positions to qualified candidates.

2.How can I create an effective IASA Job Bank profile?

An impressive profile is the result of hard work and thoughtful consideration on how to best present one’s talents, experience, and aspirations in the workplace.

3.Are there success stories of individuals finding jobs through the IASA Job Bank?

The IASA Job Bank has helped launch the careers of many people who are now flourishing in the insurance business.

4.How can I stay informed about the latest developments in the insurance industry through IASA?

The International Air Transport Association offers webinars, documents, and industry events to keep you informed of the insurance industry’s cutting-edge trends and innovations.

5.Is the IASA Job Bank suitable for both experienced professionals and newcomers to the insurance industry?

The International Air Transport Association Job Bank is open to any individual, from newly graduated students to seasoned employees, who are interested about discovering work in the insurance profession.

-

TECH8 months ago

TECH8 months agoExploring the Exciting Features of PHP Version 8.1 for Enhanced Web Development

-

CRYPTO4 months ago

CRYPTO4 months agoUnlocking the Potential: Understanding WalletConnect là gì

-

NEWS5 months ago

NEWS5 months agoBestadvise4u.com News: Your Gateway to Informed Living

-

ENTERTAINMENT5 months ago

ENTERTAINMENT5 months ago“кинокрадко” – Unmasking the Culprit Behind Film Piracy

-

TECH4 months ago

TECH4 months ago“몽세리 266b+v”: Revolutionizing Technology for a Better Future

-

HEALTH6 months ago

HEALTH6 months agoTough Tissue Muscle Connector: The Unsung Heroes of Movement

-

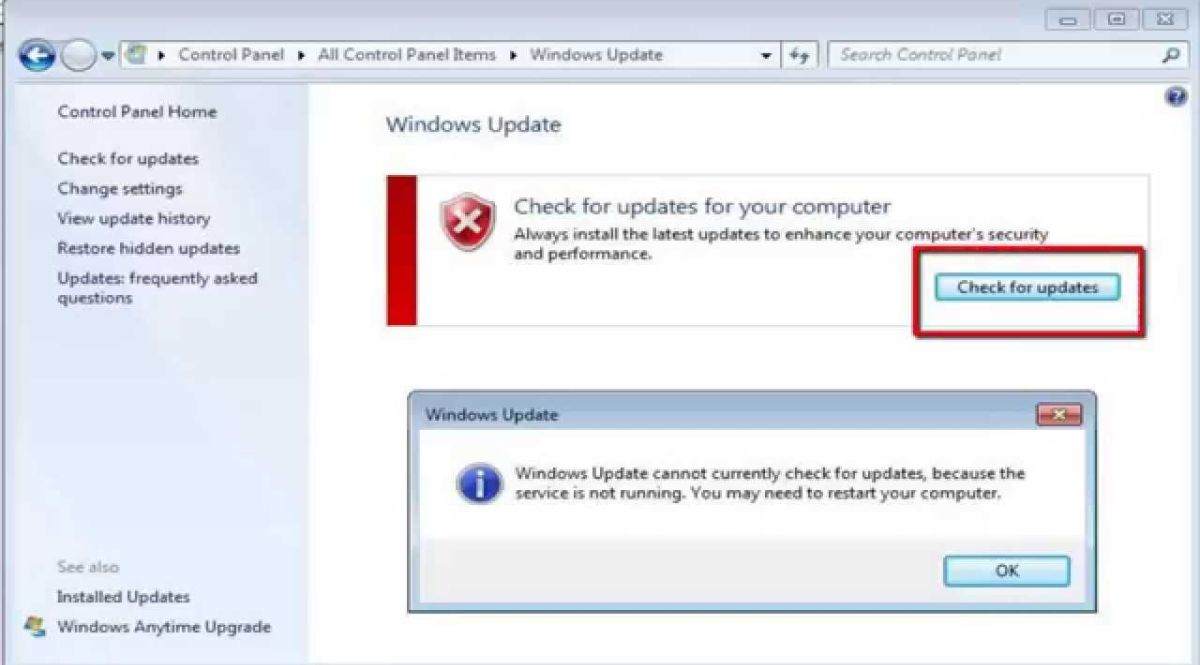

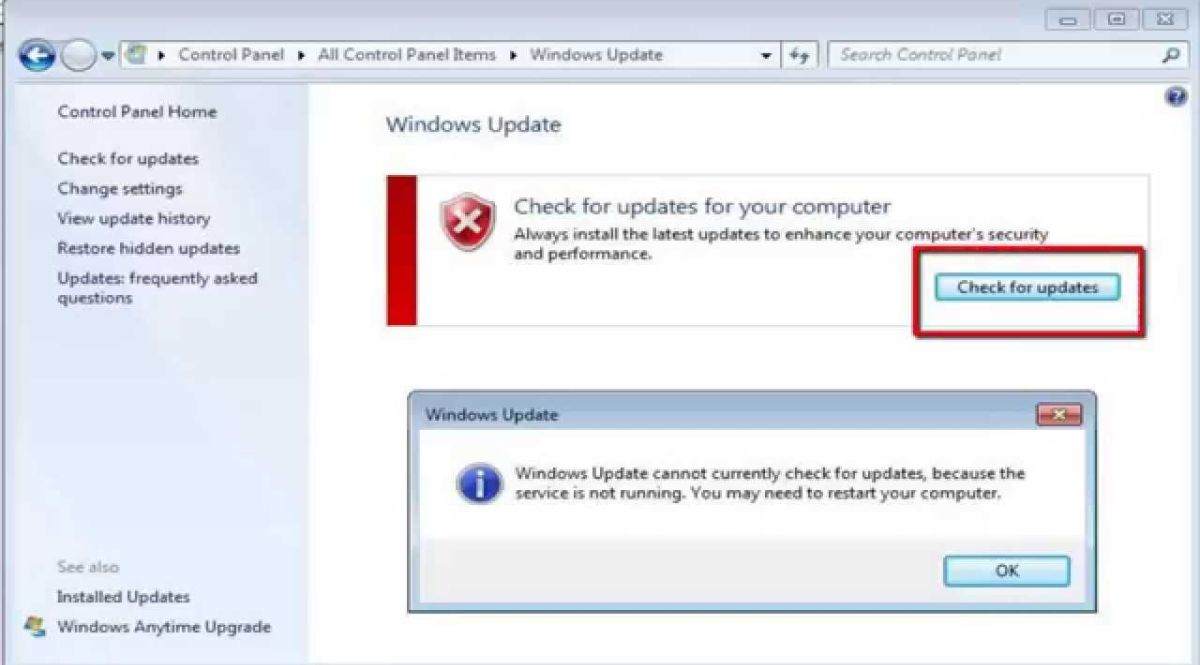

WINDOWS11 years ago

WINDOWS11 years ago(solved)-Windows update cannot currently check for updates, because the service is not running. You may need to restart your computer

-

WINDOWS9 years ago

WINDOWS9 years ago(Solved) – “How do you want to open this type of file (.js)?” Windows 8/8.1